Individual critical illness insurance: The main products available in Canada

By

Alain Thériault

|

Sept. 13, 2022, 10:35 a.m.

Flash |

Living Benefits |

Long Term Care |

Critical Illness |

Life Insurance |

LA CAPITALE |

IA FINANCIAL GROUP |

SUN LIFE FINANCIAL |

SSQ |

CANADA LIFE |

DESJARDINS |

UV INSURANCE |

RBC |

BENEVA |

IVARI |

EQUITABLE |

Distribution |

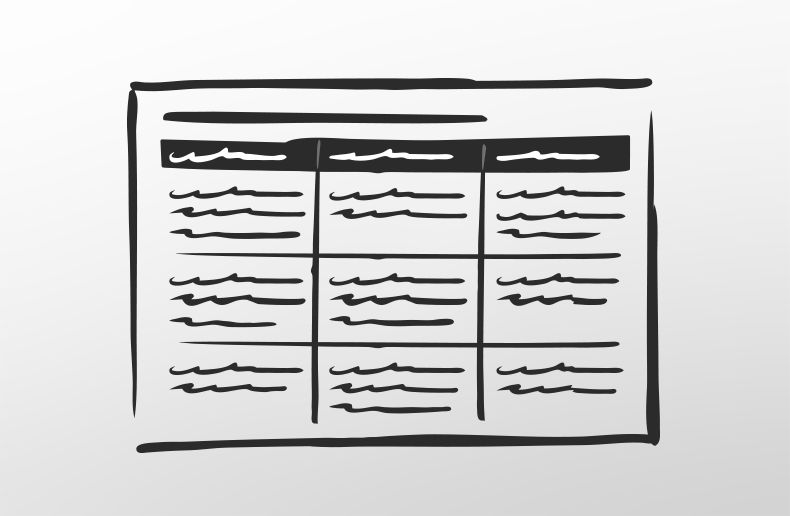

Product tables |

Magazine supplement

Seventeen springboards for talking to your clients about their health and life plans: InsuranceINTEL compares the wide range of critical illness insurance products on the market.

This article is reserved to PRO Level subscribers

Discover the PRO Level

Already subscribed? Sign in >

You are already subscribed

If your access is suspended, please verify and update your credit card in your profile.

×

Advertisement

The most popular in Life Insurance

Make your business shine with Visibility360!

Get a PDF version to share in your networks.

I'm interestedHeadlines

Advertisement

Related topics …