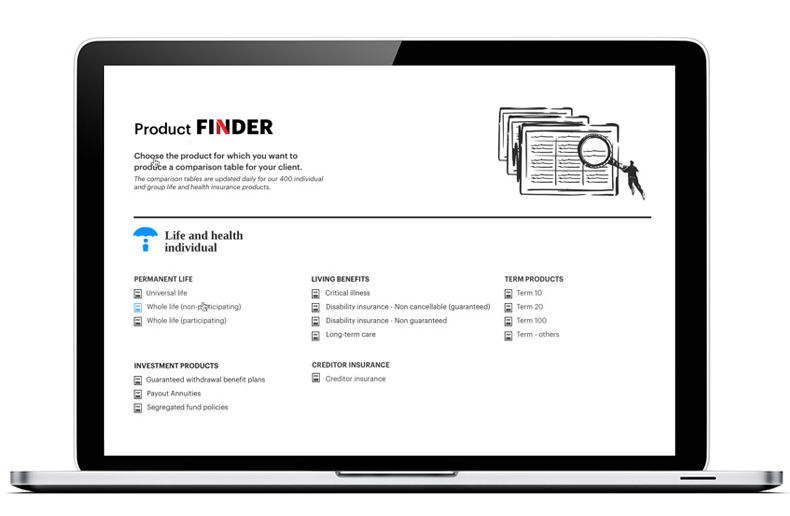

Product Finder enables you to access additional information on more than 400 products!

The non-guaranteed disability insurance product may be a worthwhile alternative to non-cancellable products. For example, financial advisors can steer early career clients toward non-guaranteed products in order to save money.

The InsuranceINTEL Intelligence Centre, The Insurance Portal's sister company, compares 11 non-guaranteed disability insurance products. The market is six providers strong.

These products primarily target self-employed individuals and small business owners. They can also be useful for seasonal, part-time or high-risk workers, together with start-up business owners.

An array of options

Two providers offer only one non-guaranteed disability insurance product: Canada Life, with Independence Plan, and Canassurance Blue Cross (Quebec Blue Cross and Ontario Blue Cross) with Blue Vision.

Three providers offer two products: Desjardins Insurance sells SOLO Disability Income and SOLO Essential Disability Income; iA Financial Group offers the Acci-Jet Program and the Superior Program, and La Capitale Financial Security offers Simplified Accident Insurance and Pillar Series.

RBC Insurance has a line of three non-guaranteed disability insurance products: Quantum, Bridge Series and The Fundamental Series.

High risk workers

While non-cancellable disability insurance usually requires the insured to work full time for at least 30 hours per week, many non-guaranteed disability insurance products are more inclusive.

For example, RBC Insurance offers Bridge Series and The Fundamental Series to people working full-time for only 20 hours a week, as do Canada Life with Independence Plan, Blue Cross with Blue Vision and Desjardins Insurance with SOLO Essential Disability Income Insurance. The other carriers offer a solution to insured who work at least 21 hours a week, full time.

Some insurers offer a product tailored to high-risk workers. For example, iA says on its website that Acci-Jet is suitable for manual labourers who are more likely to suffer a physical injury on the job, such as a construction worker. iA mentions other high-risk occupations such as fishers and backcountry ski guides, and provides truckers with out-of-province coverage.

Guaranteed renewal

Although these insurance products are labelled as non-guaranteed, in most cases they are guaranteed renewable. The age at which the guaranteed renewal period ends varies from 65 to 75 depending on the product. Many carriers are willing to make the product yearly renewable, subject to certain conditions.

Canada Life's Independence Plan is an exception: It is the only cancellable disability insurance product. Conditionally renewable up to age 65, the insurance contract can be cancelled if the insurer's decision affects all policies in a particular risk class.

In many products, the premium is level, but not guaranteed. In some cases, the premium may increase in five- or ten-year periods.