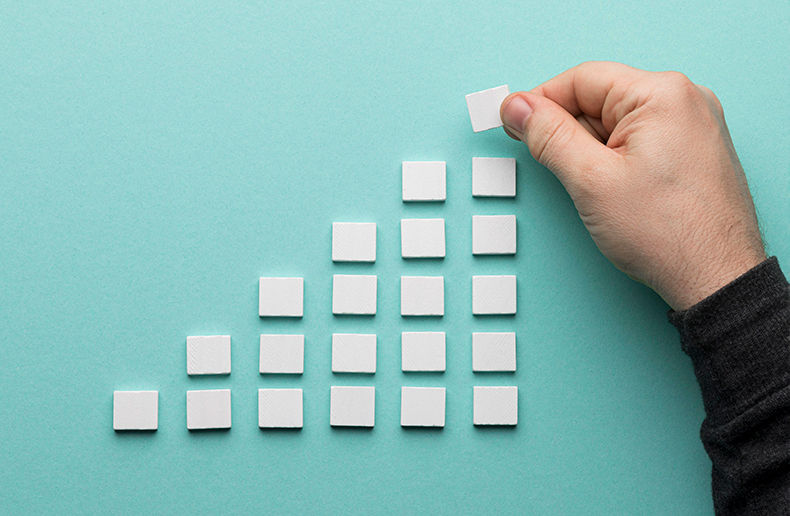

Group insurance business rose by 17 per cent in the first quarter of 2021 compared with Q1 2020, according to LIMRA’s Workplace Benefits, Canadian Group Sales report.

This result is up sharply from the 12 per cent decline in group insurance sales in 2020 compared with 2019, as indicated in LIMRA's previous report.

One in five dollars in additions to plans

Sales totalled $900,276 million (rounded to $900 million by LIMRA in the table above) in the first quarter of 2021. New sales accounted for 80 per cent of total sales in Q1 of 2021, and additions to existing plans made up the remaining 20 per cent.

Looking at total sales, $708 million went to group health benefits in the first quarter of 2021, a 26 per cent increase over Q1 2020.

Group long-term disability sales were $135 million, down 5 per cent from the first quarter of 2020. Group life sales slumped by 12 per cent to $57 million in the first quarter of 2021 compared with Q1 2020.

Five insurers control vast majority of sales

The top five sales leaders in the first quarter of 2021 boasted 83 per cent of total sales. These insurers are, in alphabetical order, Canada Life, Desjardins Financial Security, iA Financial Group, Manulife and Sun Life.

LIMRA compiled results from 17 insurers, including those mentioned above, Blue Cross in five regions (Alberta Blue Cross, Manitoba Blue Cross, Medavie Blue Cross, Pacific Blue Cross and Saskatchewan Blue Cross), along with Assumption Life, Equitable Life, The Co-operators, Empire Life, Green Shield Canada, RBC Insurance and SSQ Insurance.