Natural disasters continued to take a heavy toll in 2021. Several recent studies size up the economic losses, which are largely not covered by insurers.

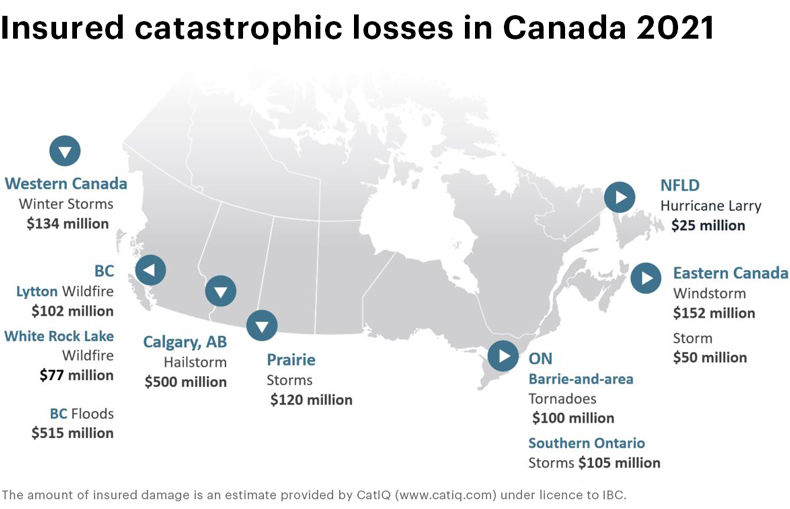

On January 18, the Insurance Bureau of Canada (IBC) listed the top ten weather-related losses in 2021 across the country. Insured property damage due to severe weather events hit $2.1 billion in 2021.

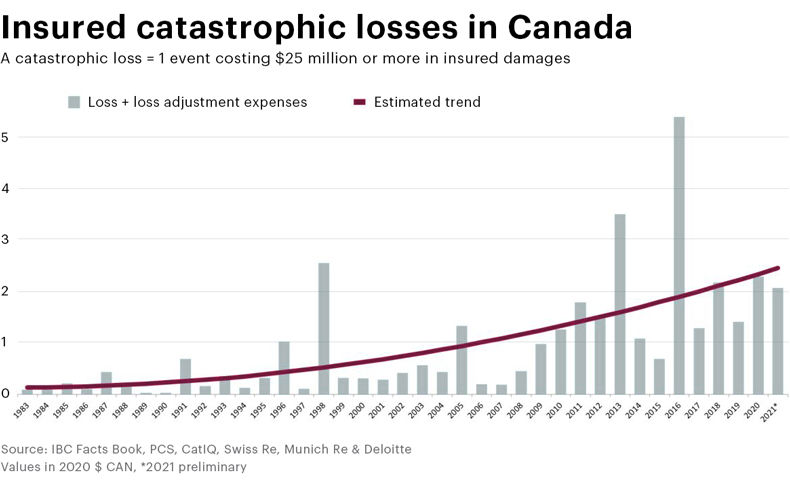

Among the years with the highest insured loss amounts since 1983, 2021 ranks sixth.

The July 2 hailstorm in Calgary and the November flooding in British Columbia inflicted more than $500 million in insured damage.

“Canada must now prioritize climate defence,” says Craig Stewart, Vice President of Federal Affairs at IBC. He adds that the federal government should allocate robust funding in its upcoming budget to implement its national adaptation strategy, expected to be announced in fall 2022.

From 1983 to 2008, Canadian insurers received a modest $422 million per year in severe weather claims. “The new normal for yearly insured catastrophic losses in Canada has become $2 billion, most of it due to water-related damage,” Stewart points out.

Following IBC’s push for a national flood action plan, Ottawa formed the Task Force on Flood Insurance and Relocation in late 2020, which is expected to report this spring.

In the absence of reliable flood maps, the insurance industry also funded Canada’s first national flood model, IBC added in its release.

Swiss Re study

On December 14, the Swiss Re Institute released its preliminary sigma findings: Global insured losses caused by national catastrophes were estimated at US$105 billion. Man-made disasters triggered another $7 billion in losses.

According to the Institute’s sigma platform, which has collected claims data since 1970, 2021 ranks as the fourth worst year for insured losses.

Economic losses in 2021 are estimated at $259 billion, compared with the 10-year average of $229 billion per year. Martin Bertogg, Swiss Re’s Head of Catastrophe Perils, points out that at $112 billion, insured losses in 2021 again exceeded the 10-year average ($86 billion). The trend of a five to six per cent rise in losses continued last year.

“It seems to have become the norm that at least one secondary peril event, such as a severe flooding, winter storm or wildfire, each year results in losses of more than USD 10 billion,” Bertogg says, adding that Hurricane Ida caused even greater damage.

Jérôme Jean Haegeli, the reinsurer’s Chief Economist, adds that the impact of natural disasters in the past year underlines the importance of investing significantly in strengthening infrastructure to mitigate the damage caused by extreme weather conditions. In the U.S. alone, the investment gap to maintain infrastructure is $500 billion on average per year until 2040.

The reinsurer notes that even though fires ravaged vast swathes of forest areas in California in 2021, they affected less densely populated areas than in 2017, 2018 and 2020.

Munich Re weighs in

Reinsurance firm Munich Re published its estimates of the damage caused by natural disasters on January 10. The economic losses are estimated at US$280 billion, of which insurers cover US$120 billion (43 per cent).

Munich Re also ranks 2021 as the fourth worst year for natural loss damage. The largest losses were in the U.S., with Hurricane Ida and its $65 billion in damage ($36 billion of which was insured), and in Europe, where summer storms caused major flooding in several countries. Damage was estimated at $54 billion, of which $13 billion was insured.

In Germany, the damage is estimated at $40 billion, of which $9.7 billion was insured. The country sustained its costliest natural disaster in its history, caused by the low pressure system dubbed Bernd. The resulting rainfall took more than 220 lives.

The United States again accounts for a large share of economic losses from natural disasters, with $145 billion in damages, of which approximately $85 billion is insured. Damages are significantly higher than in the previous two years.

The December tornadoes that struck six central and southeastern states caused major damage. Initial estimates put the losses at $5.2 billion, including $4 billion in insured damage. More than 90 people died, most of them in Mayfield, Kentucky, which was devastated by an F4 tornado.

“The 2021 disaster statistics are striking because some of the extreme weather events are of the kind that are likely to become more frequent or more severe as a result of climate change,” says Ernst Rauch, Munich Re’s Chief Climate Scientist.

Scientific studies forecast an increase in the frequency of hurricanes and of storms with extreme rainfall due to climate change, he notes.

“Even though events cannot automatically be attributed to climate change, analysis of the changes over decades provides plausible indications of a connection with the warming of the atmosphere and the oceans,” Rauch adds.

Greater insurance density helps people and countries better cope with the consequences of a natural disaster, Rauch continues. He recommends establishing public-private partnerships in this area.

The reinsurer also stresses the importance of not underestimating the threat posed by earthquakes and volcanic eruptions. In September, lava flows from the Cumbre Vieja volcano destroyed some 3,000 properties in the Canary Islands. It was not until December 25 that local authorities declared the eruption over. The damage is estimated at US$1 billion, of which only a very small portion is covered by insurance.

On top of that, the eruption of the Mount Semeru volcano on the island of Java, Indonesia, killed more than 50 people in December.

Aon report

Aon released its global disaster cost report on January 25. Only 38 per cent of losses in 2021 were covered by insurance. All amounts below are in US dollars.

The 2021 Weather, Climate and Catastrophe Insight report estimates global economic losses associated with natural disasters at US$343 billion last year, of which US$329 billion resulted from weather and climate events.

Economic losses were four per cent higher in 2021 than the average for the previous decade, and 15 per cent higher than the median for 2011-2020.

The year 2021 is the seventh costliest year on record in terms of damage, after adjusting for inflation, but had the third highest economic cost solely from weather and climate events, behind 2005 and 2017, the report states.

Roughly $130 billion of these losses were covered by insurance policies. Seventy-one percent of these insured losses occurred in the United States. In addition, Hurricane Ida caused at least 96 deaths.

Natural disasters

Losses increased from the previous year, but the number of catastrophes declined slightly from 416 major claims in 2020 to 401 in 2021. Aon says that this trend illustrates the higher cost and severity of these losses.

Aon considers a natural disaster to be an event that meets at least one of the following criteria: Economic loss of $50 million, insured loss of $25 million, 10 fatalities, 50 injured, or 2,000 claims.

In 2021, 50 events triggered economic losses of at least $1 billion, the fourth highest year on record. Over 20 losses reached the $1 billion insurance threshold, 14 of which occurred in the United States.

Four major events surpassed $20 billion in economic loss: Hurricane Ida, flooding in Europe in July, flooding in China and the polar vortex that hit the United States and Mexico in February. According to Aon, this is only the second time that four major events have occurred in the same calendar year. The first time was in 2004, when two earthquakes caused enormous damage. In 2021, all four events are climate-related.

“Clearly there is both a protection and innovation gap when it comes to climate risk,” says Stéphane Lespérance, president of Aon in Canada. The way we assess and prepare for these risks cannot depend on solely historical data. Technologies such as artificial intelligence and predictive models that are constantly learning and continuously evolving to map climate volatility will help organizations make better decisions, he says.

In Canada, British Columbia was hit particularly hard by the heat wave and forest fires in June that caused more than 800 deaths. In November, heavy rainfall caused major flooding. Losses were estimated at $2.4 billion, of which only $400 million was insured. The temperature of 49.6°C (121°F) recorded in Lytton on June 29 was the highest ever reported north of 45 degrees latitude.

What’s more, 2021 was the costliest year in history for insured losses in Germany, Belgium, Austria, Luxembourg and the People's Republic of China. The $130 billion in insured losses in 2021, including $127 billion directly related to weather, adds up to the fourth worst year for insurers, following 2017, 2011, and 2005.

Natural disasters took about 10,500 lives, including 6,500 fatalities in the 10 most severe events. The August 14 earthquake in Haiti was the deadliest with 2,248 deaths, followed by seasonal flooding in India (1,282) and a prolonged heat wave in June in western North America (1,029).

Impact of global warming

Much of the Aon report is dedicated to highlighting the impact of climate change. According to a study by the National Oceanic and Atmospheric Administration (NOAA), the most significant change associated with warming is not the extreme temperatures recorded during the day. Rather, higher nighttime minimum temperatures are the biggest driver of global warming. In densely populated urban areas, nights where the temperature does not fall below 20°C are becoming more frequent.

“Most of the world’s homes, business and infrastructure were built to meet the needs for a 20th Century climate. As the effects of climate change accelerate, the need to prepare for the more intense events of tomorrow becomes more urgent with each passing day” Aon says in its report.

The impacts of climate change are also being felt in the workforce. For industries heavily based on construction or agriculture, a 2019 study by the International Labor Organization (ILO) estimated that global warming would trigger a two per cent reduction in the number of hours worked by 2030 because of lost work or slower work pace. This productivity slide might even reach five per cent in Southern Asia or Western Africa.

The Aon report also discusses severe convective storms (SCS), greenhouse gas emissions, ocean warming, melting glaciers in the Arctic and Antarctic and their impact on sea level rise and climate extremes.