The frigid temperatures that struck Canada’s western provinces last January caused insured damage estimated at more than $180 million, reports the Insurance Bureau of Canada (IBC).

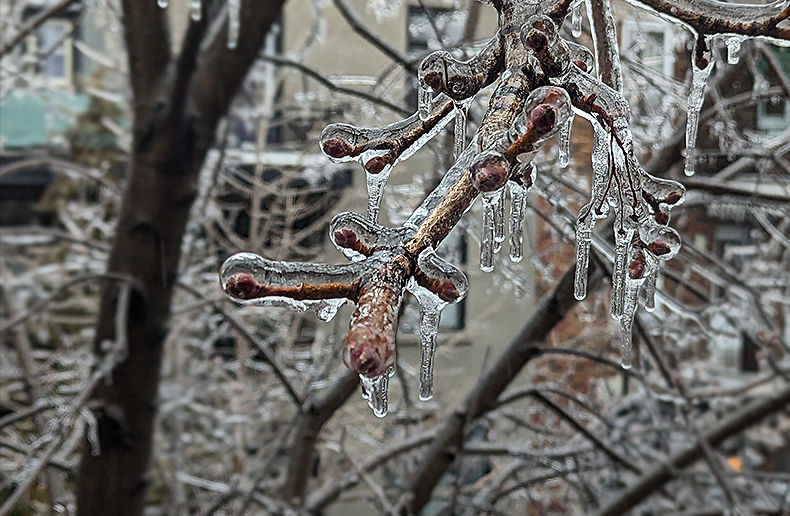

The estimate comes from Catastrophe Indices and Quantification (CatIQ). The temperature at the beginning of the year was unseasonably mild at the start of 2024. Then, starting January 12, daytime temperatures dropped sharply and remained very cold for several days in British Columbia, Alberta, and Saskatchewan.

Environment Canada reported dozens of new daily minimum temperature records. In Edmonton in particular, mercury levels showed temperatures between -40 and -45 degrees Celsius for four consecutive days.

Plumbing damage

According to Rob de Pruis, National Director, Consumer and Industry Relations at the IBC, the extreme cold led to numerous claims related to frozen and burst pipes. About 70 per cent of property damage insurance claims were related to this type of personal property damage.

Claims such as water damage due to burst pipes are typically covered in standard home insurance policies. However, there are limitations if the home is uninhabited during the winter. “This may require someone check on your home every day or every other day, while you are away to ensure the heat is maintained and minimize potential damage by detecting it early,” explains IBC.

“As the frequency and severity of weather events continue to increase in Western Canada, so too do the financial costs borne by insurers and taxpayers,” adds de Pruis.

The IBC underlines that the claims bill resulting from severe weather conditions exceeded $3.1 billion in 2023 for the entire country.

Insured losses due to severe weather “now routinely exceed $2 billion annually. By comparison, between 2001 and 2010, Canadian insurers averaged $675 million a year in losses related to severe weather,” says IBC.