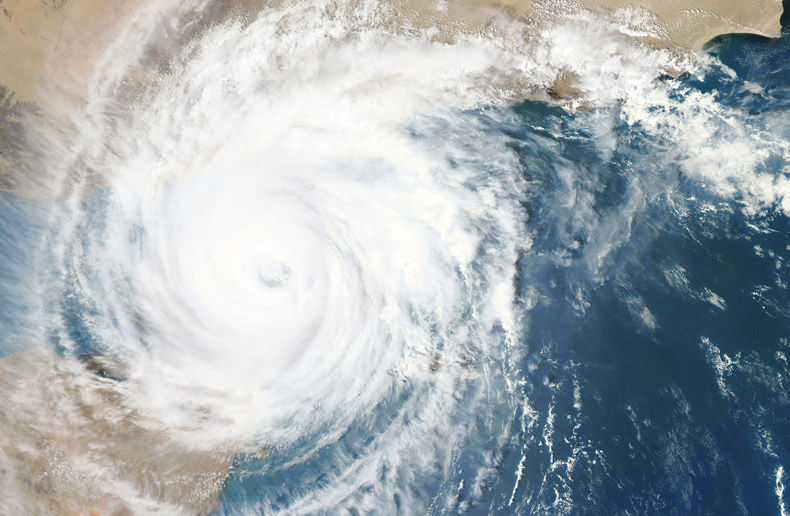

Natural disasters are escalating around the planet.

Scientists agree that this increase is fuelled by climate change.

Reinsurers have been stepping up their efforts to incorporate the effects of climate change into their decision-making, but many need to reinforce this component of their management, S&P Global Ratings says in its report Global Reinsurers Grapple With Climate Change Risks. The rating firm thinks reinsurers are underestimating their exposure to this risk, sometimes by 33 per cent to 50 per cent depending on the companies evaluated. S&P also finds that “only” 35 per cent of the reinsurers surveyed include a specific component of their price allocated to climate change.

“Unmodelled risks and the inherent difficulties in attributing extreme events to climate change create the risk that climate change may not be fully reflected in catastrophe modeling, particularly in the short term,” says Dennis P. Sugrue, credit analyst at S&P Global Ratings. “Companies that take a more proactive approach to understanding and adapting their exposure to climate risk will be better protected against future capital and earnings volatility linked to climate-related losses.”

S&P Global Ratings is concerned that both reinsurers and insurers believe that the risk posed by climate change will not be felt for some time. “At present, the ability to annually reprice most property policies provides them with some insulation. However, there is clear scientific consensus that climate change is already influencing the frequency and intensity of extreme weather – and therefore (where not suitably mitigated), insured losses – today,” the rating firm’s report states.

Capital in peril

S&P provides a 30-year comparison between historical premium rate movements for global catastrophe losses and the amount of estimated rate increases needed to account for future climate-related losses. “We consider exposure to the physical risks of climate change to be a key factor in our ratings on 19 of the top 21 rated reinsurers, primarily through our forward-looking assessment of risk exposure,” S&P states in its report.

The rating firm’s scenario highlights that for the most recurrent events, those occurring once every 50 years or more often, there is a risk that the industry’s exposure is underestimated. S&P believes that reinsurers’ and insurers’ exposure to once-in-200-year and once-in-250-year events is similarly underestimated. To address this, reinsurers and insurers must increase their capital reserves, the rating firm advises.

Following France’s lead

To back its predictions, S&P gives the example of the recent climate stress test conducted by the Autorité de contrôle prudentiel et de résolution on banks and insurers in France. The regulator found that natural catastrophe loss ratios could increase two- to fivefold by 2050, which would translate into an increase in premiums to insure natural catastrophes in France of 130 per cent to 200 per cent over the same period, or an average annual increase of 2.8 per cent to 3.7 per cent.

“These examples show how difficult it may be for the industry to increase prices over a longer period of 30 years, while current hardening price cycles are much shorter and are following usually regional loss events,” the rating firm points out.

S&P goes on to mention that the P&C insurance market has been in a hard rate environment since 2018, following large catastrophe losses in 2017.