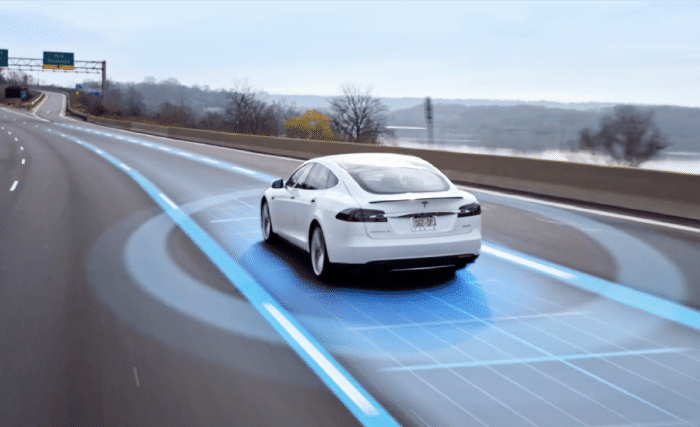

As autonomous vehicles are gradually making inroads on the market, insurers are being forced to review automobile risk pricing thoroughly. A recent study shows that it is in the P&C insurance industry’s best interest to participate in the harmonization of the rules that will govern the use of autonomous vehicles on the road.

Travelers Canada has just released the Canadian edition of Insuring Autonomy: How auto insurance will lead through changing risks, a report produced by researchers at the Washington-based Travelers Institute.

The authors note that there are still many unknowns associated with autonomous vehicles (AV), including how long it will take to transition to a fully autonomous fleet. The period until that time may be marked by unintended consequences and disruptions, the report emphasizes.

The researchers are convinced that the existing auto insurance structure is the best method of compensating victims quickly and efficiently in the future and minimizing issues caused by the diversity of regulatory frameworks across jurisdictions.

Required needs

Regardless of whether the vehicle is driven by the insured or not, there will always be risks to be covered, including damage caused by weather-related losses and vehicle theft. Despite the potential reduction in crash frequency, AV owners will still need to adequately insure their vehicles. During the transition to the fully autonomous fleet, insurers must continue to educate consumers about safe driving.

The researchers add that AV may even be associated with new forms of risk, such as cybersecurity. Regulators should facilitate data sharing between manufacturers and insurers while protecting personal information. This sharing of information will make it easier to analyze the cause of the accidents and determine liability.

New risks

In 2020, the reduction in traffic congestion, due to shutdowns linked to the COVID-19 pandemic and to a corresponding increase in remote work, affected claims and losses. In Ontario alone, collisions slumped by 26 per cent in 2020 versus the previous year.

In contrast, the number of fatal crashes rose by 22 per cent during the same period. The Ontario police authorities attribute this increase directly to human behaviours associated with alcohol use, speed, driver distraction and non-use of seatbelts. Similar trends have been observed in other jurisdictions, the Travelers researchers say.

A 2020 survey conducted by the AV industry in the US found that AV technology is not ready for prime time, with 20 per cent of respondents saying they believe AVs will never be safe. Development of AV is still in its infancy, and two deaths in 2018 during tests conducted by Tesla and Uber have shown the technological limitations of these vehicles. The main goal of using AV is to improve road safety. According to a U.S. study, some 94 percent of crashes between 2007 and 2015 were due to driver error.

It is highly likely that the trend toward greater use of AV will reduce crashes, the Travelers report continues, adding that driver distraction remains a problem that needs to be addressed.

In a March survey in the U.S., Travelers reported that more and more drivers are admitting to using their cell phones while driving. CAA has confirmed the same phenomenon in Canada.

Travelers is continuing its “Every Second Matters” campaign launched in 2017, whose goals include improving road safety and creating social stigma around distracted driving.

Risk sharing

A RAND Corporation report cited in the study states that it is imperative to design insurance products that will quickly compensate accident victims when an AV is involved. Otherwise, consumers and victims will have to engage in lengthy lawsuits. The researchers emphasize that an insurance and legal system based on product quality and manufacturer liability should be avoided.

Their study cites the example of Takata airbags, which are installed by most automakers, and for which the first problems with defects were noted back in 2004. Some manufacturers are still embroiled in lawsuits and compensation arising from the use of these products. Travelers is convinced that insurance remains the best mechanism for managing the risk associated with AV.

The subrogation process that is already in place in automobile insurance should also apply to AV claims. The insurer will continue to compensate the victim and will then take the necessary steps to obtain those payments from the AV maker if a failure is attributable to a manufacturing defect.

Transport Canada reports that there were 1,922 deaths and more than 150,000 injuries on roads across the country in 2018.