At a meeting held last November by Quebec regulator, the Autorité des marchés financiers (AMF), Jean-Philippe Desbiolles presented a cognitive technology system developed by IBM. He took the opportunity to reassure financial advisors and brokers: artificial intelligence will not replace them. Instead, it will help them to make the right decisions.

It was in 1997 that cognitive technology was truly born, with a name that will be remembered forever in the history of artificial intelligence: Deep Blue. At the time, it concerned a battle between the greatest chess player of the time, Garry Kasparov, and a “supercomputer”. After losing a number of matches, Deep Blue ended up beating the Russian champion several times.

“By winning, the human being taught the machine how to beat him. This is the concept of machine learning,” explains Jean-Philippe Desbiolles, who is global partner in the financial services division of IBM Watson Group, the name of the artificial intelligence system created by IBM. In fact, Watson is a cognitive technology that processes information more like a human than a computer, using an understanding of natural language and generating hypotheses based on conclusive evidence and learning.

Learning is precisely what Watson does best. The computer increases its knowledge in three ways: through what users teach it, what it deduces from previous interactions, and the new information it receives. In other words, organizations can use the technology to better understand and use the data around them, and then apply it to make better decisions.

The experiment conducted in 2011 involving the game Jeopardy (see The Jeopardy Challenge below) allowed Watson’s various learning levels to be developed in three stages: the machine needs to understand natural language, generate and evaluate hypothesis, and then make a decision with respect to risk and potential gain by adapting and learning.

Cognition, prediction, prescription

“In banking, Watson is involved at the customer experience level, in investment management, and in matters concerning risk and compliance. It works on three levels: cognition, prediction, prescription,” explains Desbiolles. “My banking clients are teaching Watson how to do the work of bankers.”

Indeed, the machine is continuing to improve, and provide probabilistic answers. “Watson knows what he knows, but also what he does not know,” says Desbiolles.

Thanks to Watson, we can recreate a semi-human relationship with the machine thanks to an evidence-based system, he adds. Watson therefore improves the human being’s role and the value by helping him in his work. But at no time does it replace him.

And in the event Watson is made available to those who manage clients, they will teach Watson how to deal with their customers.

“We’re actually talking about a transfer of knowledge. Because in our business, the most important thing is precisely the knowledge, knowing how to do things, and how to conduct oneself,” comments Desbiolles, who has over 18 years of experience in the financial services industry.

“Knowing how to conduct oneself, Watson does not support that. However, it can acquire knowledge and know-how. Watson is not programmed. It is a system in which each account manager teaches Watson what is correct and what is not, what is good and what is not good,” he notes.

The adviser is therefore required to spend a great deal of time with the system because Watson is a bit like a child in that he learns quickly, has a limitless memory, and he never tells lies. Hence the importance of the person who trains Watson, and who ensures that his education is a good education. For, as with children, a poor education will lead to deviant or bad behavior. If it is well educated, however, the advisor will have a tool that offers a high added value. “Unlike a computer program, Watson is an endless process. It is never finished learning. It must be constantly taught in order to improve its results,” says Desbiolles.

The advisor makes the decisions

Faced with the development of artificial intelligence and cognitive technologies in the banking and insurance industry, advisors may worry whether or not they are going to put themselves out of business by transferring expertise to a system which is able to advise their clients on its own.

On the contrary, Jean-Philippe Desbiolles thinks that cognitive systems like Watson bring a lot more power to consumers than they have today, and potentially to advisors as well.

Why is this? “Because we all know there are risks that we are prepared to accept and some we are not. It is a very personal decision. Watson is an evidence-based system, a system that provides you with the evidence to support a position. Watson, if it has a sufficient amount of knowledge, can bring you all the evidence, but in the end it is the advisor and the client who make the decision,” Desbiolles says.

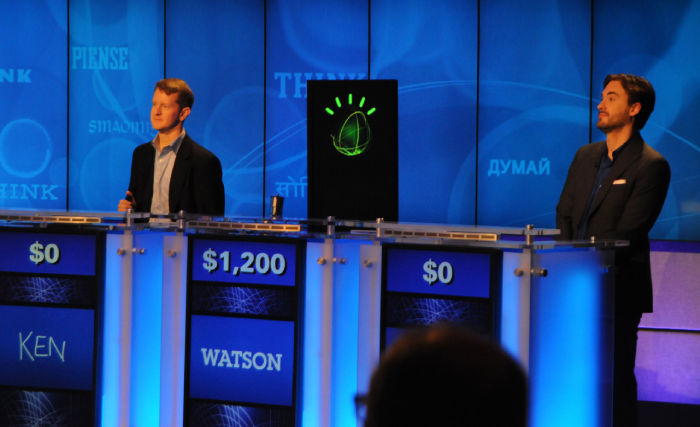

The Jeopardy Challenge

In February 2011, IBM's Watson beat champions Brad Rutter and Ken Jennings at Jeopardy. Known for its complex trick questions, the popular game became the ideal choice for the IBM Research team because of the extraordinary challenge it presented. To play and win, Watson had to answer questions posed in all the nuances of natural language, including puns, synonyms and homonyms, slang and jargon.

It should also be noted that Watson was not connected to the Internet during the show. Everything it knew had been amassed over years of interaction and learning and was based on a large body of unstructured knowledge. By focusing on machine learning, statistical analysis, and natural language processing in order to find and understand the clues in the questions, Watson compared possible responses by classifying them according to the degree of trust he gave to their accuracy and he then responded, all in about 3 seconds.