The insurance industry will grow faster than it did in the aftermath of the 2008 stock market crisis, Swiss Re predicts in its report World insurance: the recovery gains pace.

The reinsurer forecasts global premium growth of 3.3 per cent in 2021 and 3.9 per cent in 2022.

However, much of this growth will be due to the tightening of commercial lines underwriting conditions, which has been described as “the strongest rate hardening for 20 years.” Swiss Re expects premiums in this sector to be 10 per cent above pre-pandemic levels.

In property and casualty insurance, premium growth in advanced markets is estimated at 2.2 percent in 2021 and 2.8 percent in 2022. In life and health insurance, this growth is projected at 3.8 per cent in 2021 and 4 per cent in 2022. As a result, insurers will have written more than US$7 trillion in premiums by the end of 2022, Swiss Re says.

Positive changes

The reinsurer points out that the pandemic has “cemented” positive paradigm shifts for the insurance industry. One change is a significant rise in risk awareness, particularly related to cyber risk and supply chains, which is driving insurance demand.

The pandemic has also accelerated the demand for online transactions, compelling insurers to adapt.

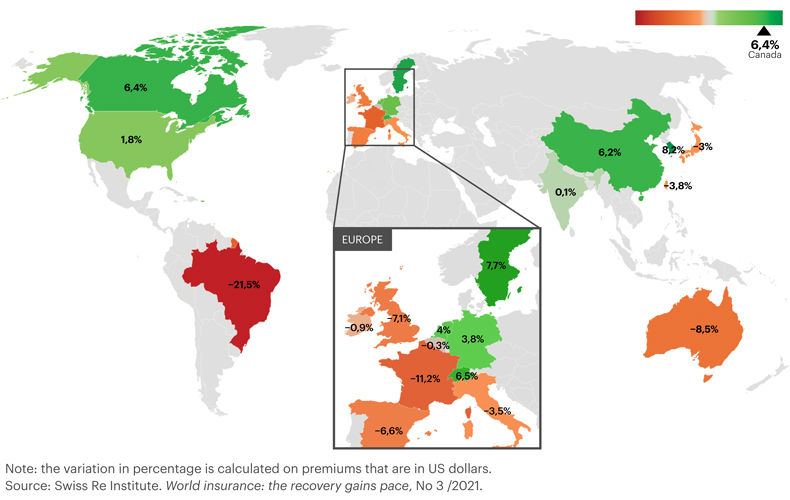

Premium volume growth in the top 20 global insurance markets: 2020 versus 2019

In 2020, insurance premium volume swelled by 6.4 per cent in Canada. The increase was 7.6 per cent in property and casualty insurance and 5 per cent in life and health insurance. Canada once again ranked 9th in the Top 20 global insurance markets, dominated by the United States, China and Japan.