Disaster costs are on the rise. Annual summaries on natural disasters in 2022 from the world's three largest insurance and reinsurance giants do not skimp on statistics to demonstrate this fact. The outlook is equally grim for total economic losses, and insured losses, and the trend is far from abating in the coming years. In such a scenario, the three giants – Aon PLC, Munich Re and Swiss Re – are calling on insurers to develop resilience measures to better protect consumers.

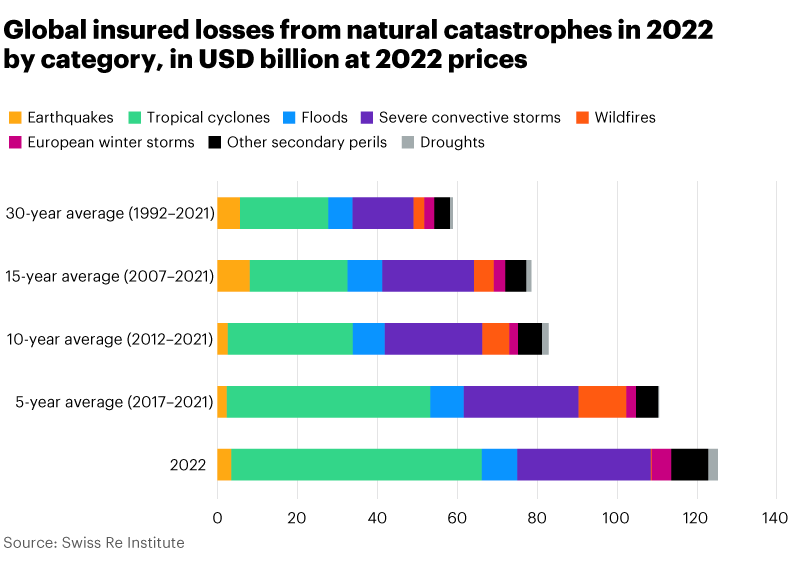

According to the evaluations of the three companies, insured losses in 2022 ranged from $120-billion to $132-billion. Munich Re states that total losses were close to the average for the last five years, while insured losses were significantly above the average of $97-billion observed between 2017 and 2021.

For its part, Aon claims that global losses from natural disasters in 2022 were more covered by insurers. The company states that with a protection gap of 58 per cent, most losses related to disasters were uninsured. While this is one of the lowest protection gaps ever recorded, matched only in 2005, the gap represents both a challenge for global resilience and an opportunity to facilitate better protection.

Aon says that extreme weather records have been broken, with many regions experiencing prolonged drought and crushing heatwaves. In its analysis, it reminds us that the impact of climate change on communities around the world is tangible.

The devastation caused by disasters worldwide shows the need to adopt more widespread risk reduction strategies, warns Aon. It suggests better disaster management and warning systems that improve resilience.

Swiss Re agrees with this assessment. The reinsurer is calling for greater rigor in the modeling and underwriting of secondary perils. Its analysts say discrepancies between risk assessment and actual exposures have resulted in inadequate market capacity.

The reinsurance industry has long monitored primary perils, but this has not always been the case for secondary perils, Swiss Re argues. Losses related to secondary perils have been increasing for many years. This lack of granular exposure data can also impede the understanding of all current risks. For example, the increase in built land area and changes in housing vulnerability to hazards, are difficult to track. The company points to the advent of rooftop solar panels as an example of how a lack of data complicates underwriting.

The rapid pace of change in these variables requires shorter data and model update cycles, Swiss Re argues, to limit risk accumulation and loss trend underestimates.

The insured loss data for 2022 has been influenced, for the third year in a row, by the presence of the La Niña phenomenon, says Munich Re. “This increases the likelihood of hurricanes in North America, floods in Australia, drought and heatwaves in China, and heavier monsoon rains in some parts of South Asia, explains Ernst Rauch, chief climate scientist at Munich Re. At the same time, climate change is tending to increase weather extremes, with the result that the effects sometimes complement each other.”

If the costs of losses are increasing, Swiss Re says one could mistakenly think that the physical destructive force of natural disasters themselves is the cause, but they add the losses are due to economic growth, accumulation of asset values in exposed areas, urbanization, and population growth.

And this trend will continue, says Swiss Re. Its analysis predicts that these factors, and more recently inflation, will continue to increase losses. Economic inflation has risen sharply over the past two years, averaging seven per cent in advanced markets and nine per cent in emerging economies in 2022, it reports.

The volume of insured losses in 2022 confirms, according to Swiss Re, a trend of annual growth between five and seven per cent, in place since 1992.

Impact on rates

Given this global picture, Swiss Re expects the difficult market for reinsurance and insurance to persist.

Its analysts say there is increasing demand for coverage and higher insured asset values, and constraints on capital supply, which has decreased due to rising interest rates.

And Swiss Re points to one industrial sector that complicates the picture: The real estate market. In the United States, for example, the total replacement cost of buildings in 2022 has increased by about 40 per cent since the beginning of 2020.

This high inflation has been caused by the pandemic, the war in Ukraine and the heavy monetary and budgetary spending of many countries, reports Swiss Re. This was enough to trigger a spiral of rising costs of materials and labor, coupled with an increase in compensation claims to cover the rising costs of building repairs. Six years of weak results in real estate underwriting have reduced appetite for this risk, its analysis reports.