Disability insurance is one of the cornerstones of financial security, like life insurance and critical illness insurance. What sets it apart from the other two is the importance insurers place on the client's profession when pricing these products.

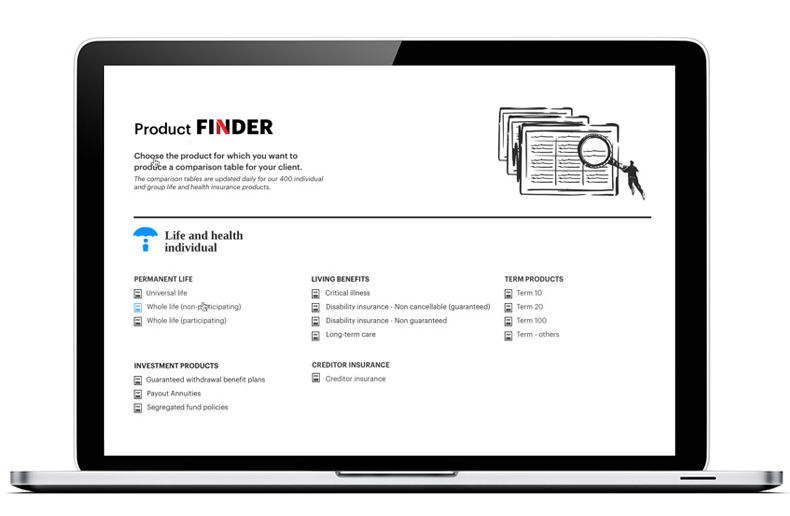

Availability of disability insurance is abundant, despite the withdrawal of certain insurers over the years, including Manulife for non-cancellable disability insurance in 2022, and Blue Cross Canassurance for non-guaranteed disability insurance in 2023. According to the comparative tables prepared for the Insurance Portal, seven insurers offer a total of 17 disability insurance products in all categories.

Only two players remain active in the non-cancellable disability insurance market, following Manulife's departure. They are Canada Life and RBC Insurance.

Canada Life offers Lifestyle Protection, a non-cancellable product targeting salaried employees, professionals, senior executives and business owners.

RBC Insurance offers two non-cancellable disability insurance products. The entry-level Foundations Series targets clients in the same job categories as the Canada Life product, i.e. 4A, 3A, 2A, A and B. RBC Insurance’s Professional Series focuses on high-income job categories with a lower risk of physical injury: 4A, 3A and 2A.

Wall-to-wall coverage

Called “wall-to-wall guaranteed” by advisors who specialize in this niche, non-cancellable disability insurance is recognized for offering advantageous terms to professionals and business executives.

It's called non-cancellable because the insurer cannot change the premium or refuse to renew the insurance contract for a particular category of worker until the insured reaches the age of 65. After that age, renewal becomes conditional on an annual basis, and the insured must be working full-time to obtain it.

Risk appetite

According to the comparative table of non-guaranteed disability insurance products prepared by InsuranceINTEL, 7 insurers offer a total of 14 products. They are Beneva (formerly La Capitale), Canada Life, Desjardins Insurance, Humania Assurance, iA Financial Group, Manulife and RBC Insurance.

In this niche, they offer products tailored to workers who are exposed to greater risks of injury than professionals or senior executives.

For its non-guaranteed products, Insurance Without Medical Exam – Debt and Insurance Without Medical Exam – Income, Humania Assurance emphasizes that the coverage is designed for people who, for medical or other reasons, find it difficult to take out a disability insurance policy.

Part-time work and unemployment accepted

Unlike non-cancellable products offered only to clients who work at least 30 hours a week (24 hours at Canada Life for certain professions), people can access non-guaranteed disability insurance while working less than 30 hours a week. For this product, the threshold is as low as 21 or even 20 hours a week.

Manulife's Personal Accident Disability Insurance product specifies that unemployed people are eligible if they apply for a policy with a disability benefit of up to $1,000. On the other hand, this non-guaranteed product requires the insured to work at least 30 hours a week in order to purchase a monthly benefit of more than $1,000.

Job hierarchy

The 4A class refers to senior executives, such as managers or administrators, and professionals who are members of a professional order, such as doctors, engineers, lawyers and notaries.

Occupation class 3A refers to other professionals and employees who work in a very stable profession, take on major responsibilities, and work exclusively in an office or at home.

Occupation class 2A includes supervisors, certain technicians and skilled workers who do not perform manual labor.

Occupation class A refers to skilled manual workers who do not expose themselves to any particular risk in their work.

Occupational classes B and C include workers who are exposed to the greatest hazards, and therefore cannot obtain the preferred rates of class A.

Democratization

For its SOLO Essential Disability Income product, Desjardins Insurance uses classes 1, 2, 3, 4, 5 and 5B, where 5 corresponds to class B and 5B to class C. According to further research on the InsuranceINTEL site, the insurer explains that if the insured holds a class 5B job, he or she must be covered under a workers' compensation plan to be eligible for SOLO Essential Disability Income.

Desjardins Insurance adds that the coverage offered by SOLO Essential Disability Income is particularly interesting for workers in occupations that make them ineligible for traditional disability insurance coverage. Acceptance is guaranteed for accident coverage, says the insurer. This includes soft-tissue injuries, if the customer answers three eligibility questions in the affirmative.

Simplified underwriting

One of Beneva's non-guaranteed disability insurance products is called Simplified Accident Insurance. As the name suggests, no medical evidence is required, according to further research with InsuranceINTEL. Underwriting for Simplified Accident Insurance is based on three questions. Beneva requires no proof of income at issue for the first $1,200 of monthly benefits. No proof is required at the time of claim, or during the first 6 months of total disability.

However, Beneva's non-guaranteed product cannot be underwritten by electronic application, as is the case with Manulife's product. Other insurers offer this option in at least one version of their non-guaranteed products. For non-cancellable disability insurance, Canada Life and RBC Insurance offer digital application.

Did you say non-guaranteed?

Renewals for non-guaranteed disability insurance are usually guaranteed. The age at which the guaranteed renewal period ends varies from 65 to 75, depending on the product. Many agree to extend the renewal period annually, subject to certain conditions.

Canada Life's Independence Plan is an exception, as it is a cancellable disability insurance product. Conditionally renewable up to age 65, the insurance contract may be cancelled if the insurer's decision affects all policies in a given risk category.

For many products, the premium is level, but not guaranteed. In some cases, premiums may increase every 5 or 10 years.