Intact Financial Corporation announced on April 11 estimated catastrophe losses for the first quarter of 2022 of approximately $183 million on a pre-tax basis ($0.81 per share after-tax).

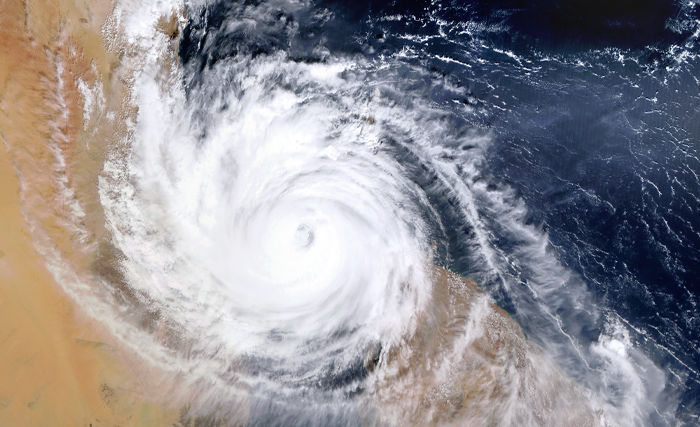

The property and casualty insurer states that about 60 per cent of the catastrophe losses were in its United Kingdom & International (UK&I) segment, mostly reflecting the impact of three windstorms in February. Close to 60 per cent of the insurer’s UK&I catastrophe losses were in personal lines.

The remaining losses were in the Canadian segment, approximately three quarters of which were attributable to personal property, says the insurer.

Nearly 80 per cent of Intact’s catastrophe losses were weather-related.

"Following a number of severe weather events this quarter, our teams responded quickly to help impacted customers and get them back on track," stated Charles Brindamour, Chief Executive Officer of Intact Financial Corporation. "As we continue to face the increasing impacts of climate change, our commitment to building resilient communities remains a core element of our strategy."