FP Canada index shows financial stress levels rising

By

Kate McCaffery

|

June 20, 2023, 10:55 a.m.

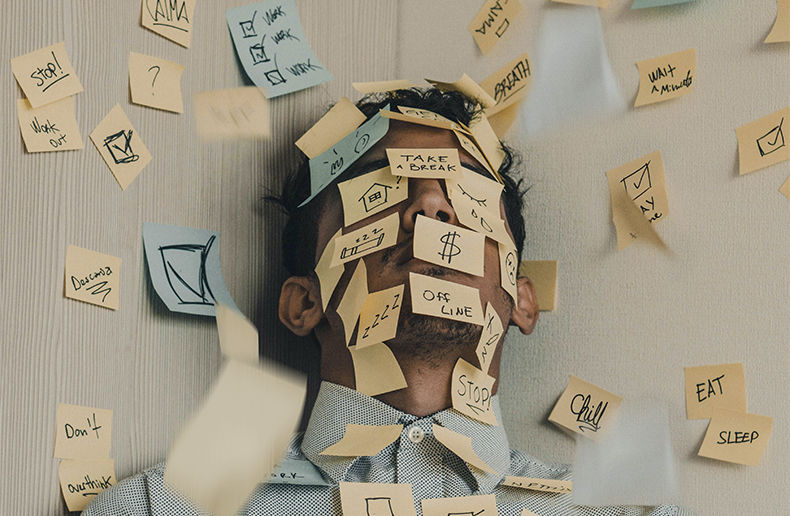

Photo: Unsplash | Luis Villasmil

Those with financial planners or advisors report being less prone to having financial regrets.

This article is reserved to PRO Level subscribers

Discover the PRO Level

Already subscribed? Sign in >

Advertisement

The most popular in Life Insurance

Make your business shine with Visibility360!

Get a PDF version to share in your networks.

I'm interestedHeadlines

Advertisement

Related topics …