As regulations make face-to-face meeting times longer and more complicated, automated underwriting can free up time for insurance advisors to do what they do best.

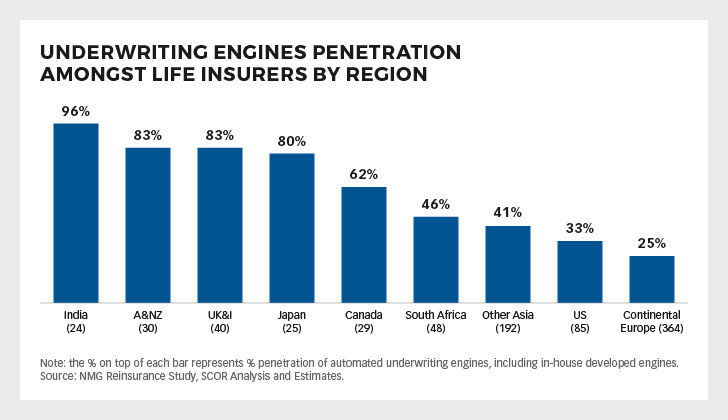

A recent white paper from SCOR considered the ways automated underwriting engines are being used throughout the world. The French reinsurer has found that customers across all major life insurance markets are far more willing to disclose information about their health than the industry typically believes. In Canada, 83% of consumers said they were willing to answer health questions in return for lower premiums.

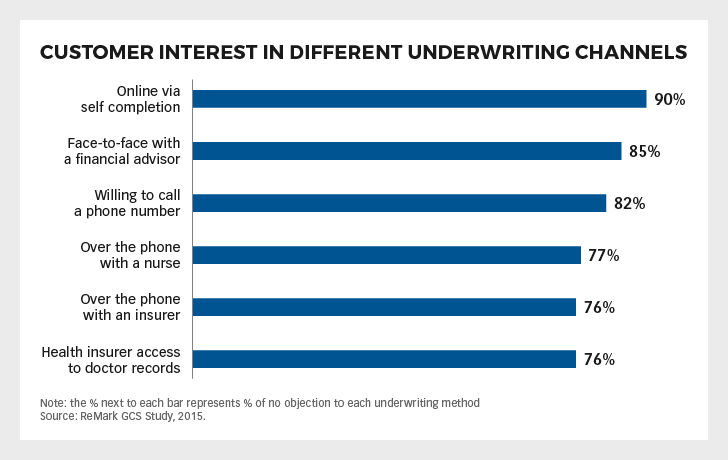

They may be prepared to answer medical questions, but do most insurance buyers want to go it alone? The research shows that most consumers still require real-time support from an expert. When asked about their preference for different underwriting channels, 90% of the survey participants said they were interested in applying online via self completion, but 85% were also interested in a face-to-face meeting with a financial advisor.

Engines to engage, not replace advisors

“All indicators point to the need for the industry to see the underwriting engine as an opportunity to engage advisors rather than replace them,” reads the report. “Engine development should be seen as an opportunity to invest in holistic innovation around business development rather than simply around efficiency. By doing so, industry players will not only harness increased efficiency, but drive growth and advisor engagement, again improving the customer journey.”

For the most part, insurers want to automate the underwriting process in order to reduce costs, but SCOR warns that “half-baked” efforts will do more harm than good. For example, an automatic application that forces an advisor to stop the application process and gather more information creates friction and could end up killing the sale.

“These problems also give advisors an excuse to drag their feet when it comes to automation – for example when customer application information is gathered by paper to be subsequently uploaded to digital,” says SCOR. “This distorts the insurer’s ability to accurately assess the customer efficacy and advisor value add of automation.”

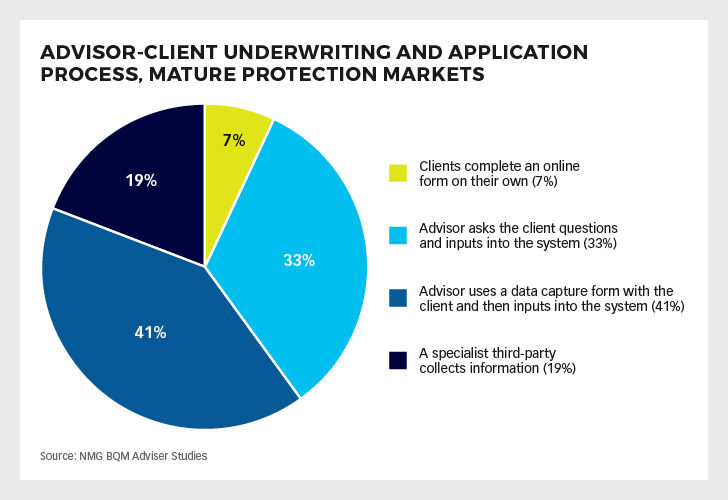

Many advisors feel that helping clients complete application forms is one of the key areas in which they add value. Some insurers may be nervous about the amount of influence human intermediaries can have over the application and the potential for adverse selection, but SCOR argues that their role in the process is a reality and most customers value their support.

Smooth the underwriting process

Instead of replacing advisors, the white paper argues that insurers should focus on creating systems that will please all of the parties involved, namely a straightforward new business platform that smoothes out the application process. “Globally, banking and wealth management regulation is extending advisor-client meeting times for the core product.” reads the report. “As a result it is more important than ever to make the life insurance application process quick and easy.”

SCOR says its Adviser Connect underwriting platform in Australia has been very successful, and is an example of how a thoughtful and well-executed digitalisation can both drive access to different market segments and generate new business growth.

Insurers that used Advisor Connect saw their application completion rates go from less than 30% to greater than 90% in one case, and they also increased straight through rates to above 30%, up from less than 10%. What’s more, there was a marked improvement in insurer proposition ratings by Australian advisors following the implementation of the platform, increasing to well above the market average.

Advisor perceptions and resistance

SCOR laments the fact that the Australian case is a relatively rare example, and notes that most reinsurer underwriting engine installations have struggled to transform advisor perceptions. In Britain, for example, the white paper reveals that rather than demonstrating how engines can improve new business processes, insurers have relied on price and commission incentives as the primary levers to encourage advisors to adopt new underwriting platforms.

When executives were asked what prevents insurers from using underwriting engines, resistance from advisors came second only to costs as the most frequently-cited barrier to implementation. Given the central role they continue to play in the application process, it will be essential to get them on side. SCOR found that in mature insurance markets only 7% of clients complete an online form on their own, and 19% of the time a specialist third-party collects the information; all of the remaining applications come from advisors who either ask the client questions and enters information into the system on the spot (33%) or who use a data capture form and enter data into the system later on (41%).

Ultimately the research suggests that it is head office staff and not insurance advisors who should be most concerned about being replaced by robots. SCOR says the use of third-party information from pharmacy profiling, the medical information bureau (MIB), and motor vehicle records is making it possible to develop pricing models which closely resemble fully underwritten business.

“Extending the super-simplified paradigm to include medical history drill-down data, paramedical and laboratory data as well as credit scores will further the growth in engine-based interactions – with minimal human underwriter intervention,” concludes the study.