It’s not often that an investors’ rights group and an industry association eagerly agree on the same topic. But when it comes to the importance of drafting a protocol for mutual fund advisors to guide them in handling issues dealing with seniors with cognitive decline as well as other vulnerable investors, there was no argument at all.

“As it happens I am a strong believer that we should co-operate and collaborate on things that are non-controversial, things that we should all agree should be done,” says Neil Gross, executive director of FAIR Canada. “Much as we may feel that there are issues that may divide us, there is still common ground on a lot of things and we try to make headway on those.”

Gross mentioned his concerns about seniors last year to staff at the Investment Funds Institute of Canada (IFIC), who told him that IFIC had already started a “vulnerable investors task force.” Chaired by Jan Dymond, IFIC’s vice president of public affairs, it has now turned into the group’s first multi-stakeholder task force and includes the Ontario Securities Commission’s Office of the Investor, New Brunswick’s Financial and Consumer Services Commission, the Mutual Fund Dealers Association (MFDA), the Investment Industry Regulatory Organization of Canada (IIROC), as well as at least six IFIC member companies – and FAIR Canada.

Cognitive decline

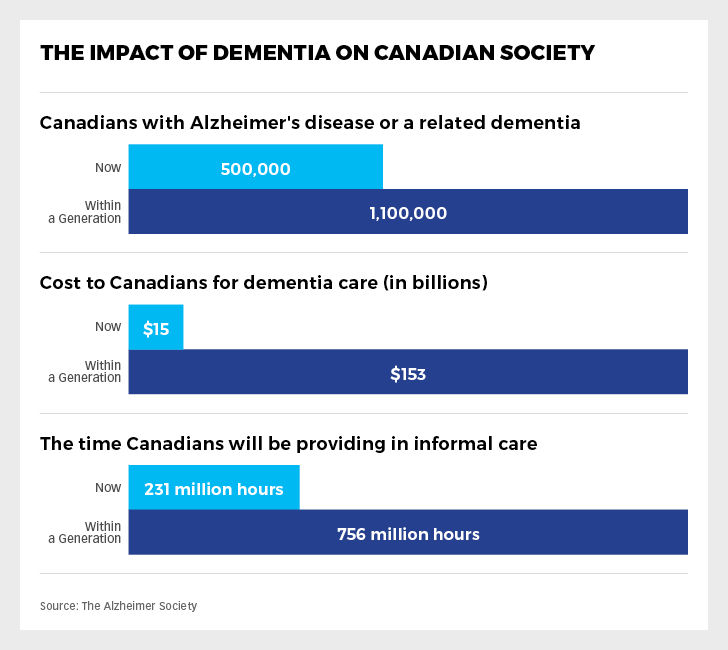

A function of aging baby boomer demographics, the number of Canadians falling prey to dementia is increasing. According to the Alzheimer Society of Canada, there are about 25,000 new cases of dementia diagnosed every year. The society estimates there are currently 564,000 Canadians living with dementia, a number that is expected to rise to 937,000 in 15 years.

But what is also plaguing the investment industry is the prolonged low interest rate environment and the dilemma many advisors face in helping clients create income leading up to and during retirement. Instilling risk in a portfolio has always been a delicate balance, but can be exceptionally tricky and dangerous with seniors with cognitive decline.

Advisors raised concerns

Dymond says IFIC started the task force after it received feedback from its dealer members that they were receiving an increasing number of questions from advisors on how to deal with clients who were starting to show poor financial judgment. They were also worried about aging clients who appeared to be coming under the influence of a third party and expressed concern about the potential of financial exploitation or abuse. The situation would become particularly acute when the market was going through a major upheaval and a decision on the advisor’s advice needed to be quick.

The task force has taken on as one of its major mandates a determination of an accepted industry protocol or regulated “safe harbour” for financial advisors – giving the dealer and its compliance department the authority to do “the right thing” in these difficult situations.

Gross recently applied for and received a grant from the Law Foundation of Ontario’s Access to Justice program to help research what other jurisdictions have put in place and their success. He expects he will formulate some strategies for the IFIC task force in about a year’s time and that, together with the task force’s input, will provide the basis for a new protocol.

Currently, clients may give instructions to their advisors that they believe is not in the best interests of their client or not consistent with a client’s previous instructions. “We have been told [that dealers] have to choose which rule to break,” says Dymond. “If they want to put the account on hold while they explore what’s going on they are not meeting the requirement to execute in a timely way. If they want to talk to a third-party, like a trusted family member, they may be breaking some privacy rules.”

Legal safe harbour

As it now stands, advisors and their firms may be sued by family or sent notice of an enforcement proceeding by a regulator if they make a decision on their own. “Unless they feel confident that they’re going to be able to take that defensive action in good faith for the benefit of the client and not suffer some kind of penalty, then they are never going to implement that protocol,” says Gross. “The question is: when we do the research and we look at what best practices are in other jurisdictions are we going to find that all those jurisdictions have come to the conclusion that it’s necessary to have a legal safe harbour as part of this? If they do then we will be recommending it in our research that Canada also follow that precedent.”

Dymond says North American securities administrators and the U.S. Financial Industry Regulatory Association (FINRA) have come up with some guidance for advisors. It says basically that under certain outlined circumstances a dealer or an advisor can put an instruction on hold and provides advisors with the steps they should be taking. The standard protocol gives dealers and advisors some confidence and cover if a family member, for example, sues them. “[However in Canada] they have to make the case and hope it turns out in their favour.”

The issue of cognitive decline has also become a major theme in many regulators’ strategic plans.

The MFDA, which held its second seniors summit last year, says it has made protection of seniors from financial harm one of its priorities. In fact, 40% of the proceedings it began last year were against members that involved seniors or vulnerable persons. It says it has helped seniors document and file complaints with the MFDA and referred them to the Ombudsman for Banking Services and Investment, which can make a non-binding recommendation on compensation.

Suitability

It also conducted a sweep last year on the suitability of deferred sales charges (DSC) given client time horizon and age, and warned members to have adequate procedures in place to disclose DSC both when clients buy and sell funds.

“As suitability continues to be an area of focus for the MFDA, particularly as it relates to senior investors, we will continue to review these issues in future compliance examinations,” the MFDA said in a bulletin. “We encourage Members with additional questions or those seeking guidance in enhancing their supervision and suitability of DSC policies and procedures to contact their assigned MFDA Compliance Manager for further assistance.”

IIROC released guidance to members at the end of May on how advisors can identify issues such as diminished capacity and financial exploitation, and suggested advisors increase the frequency of contact with senior clients and review Know Your Client and suitability requirements. It also recommends that policies and procedures be put in place to “enable the dealer to place a temporary hold on the client’s account (e.g., to allow for verification of information or instructions) in instances where financial exploitation or diminished capacity is suspected.”

Expert advisory committee

The Ontario Securities Commission (OSC) also announced in September the membership of a seniors’ expert advisory committee. The committee will help advise the OSC on securities and operational developments that affect older and other vulnerable investors.

“OSC staff recognize the importance of consulting seniors’ experts who can provide staff with expert opinion and input to support ongoing efforts to better understand the unique needs of older investors,” the regulator said in a news release. The 16-member committee includes both Dymond and Gross.

Dymond says the IFIC task force is also looking at training advisors, trying to create some consistency about how advisors should go about meeting the needs of seniors and other vulnerable groups, including those with limited financial literacy.

It has released two checklists on how advisors should approach vulnerable clients, suggesting to them that they talk with their clients early and often about what they want to do should they show signs of cognitive decline. IFIC has released a similar checklist for advisors if they observe signs of financial exploitation.

While not all seniors can be painted with the same brush, Dymond says researchers have discovered that the first abilities to go as we age relate to math and financials. A person may be able to play bridge and remember all their grandchildren’s birthdates, but the first signs of cognitive decline will come when they will have difficulty understanding and making decisions on their finances. It’s something that may not be easily detectable to family members and close friends because they haven’t traditionally dealt with financial issues, but will be noticeable to advisors.

She suggests advisors take their own baseline of a client’s financial knowledge and comfort level in discussing financial matters so if suspicions are aroused they can go back and check their notes.

The last item the task force will be dealing with is investor education, a longer term project that will point out to clients the importance of giving their advisor information on their power of attorney and the limits that can be placed on it.