Addressing The Insurance and Investment Convention in November, Eric Sondergeld, corporate vice-president and director at LIMRA, says Canada is undergoing significant demographic and consumer shifts that will continue to reshape the life insurance industry for years to come.

As part of the Destination 2036 session – at which renowned experts were asked to look at trends and how they will impact the industry over the next 20 years – Sondergeld said while the Canadian and Quebec population will continue to age, there will be growth in three key areas.

“There are three main places where we are seeing increases in population in the next decades – we’re going to see more children, more parents and more grandparents.”

Technology and insurance

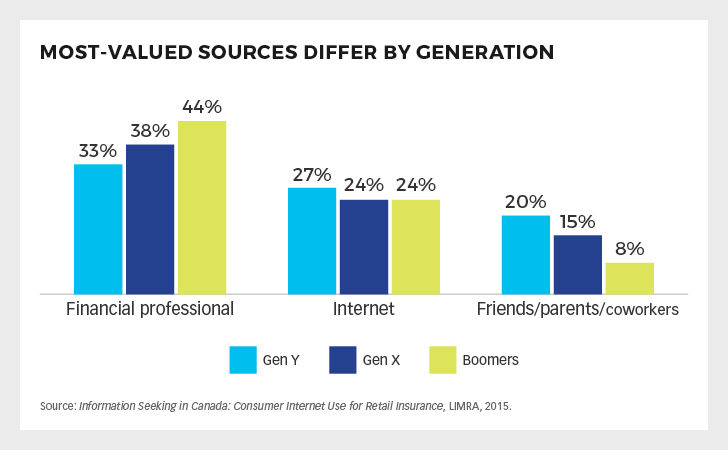

As the industry looks towards its next 20 years, potential clients are turning more to technology and other sources when looking for insurance. Sondergeld said while there is an increasing trend toward consumers using the Internet to research insurance, they still prefer to use advisors when buying it. Generation Y is leading the charge in using more sources, he adds.

“Consumers are coming to advisors with information that they want you (advisors) to validate, what they’ve learned, and they ask questions…which is much different than 10 years ago,” he observed.

In LIMRA’s 2015 report, Sondergeld says despite the increased use of technology (which was flat in their past two studies), financial advisors are still considered to be the most valuable source of information for consumers. However, he forecasts that when LIMRA conducts its survey in the United States in 2018, technology may beat out advisors as the most valuable source.