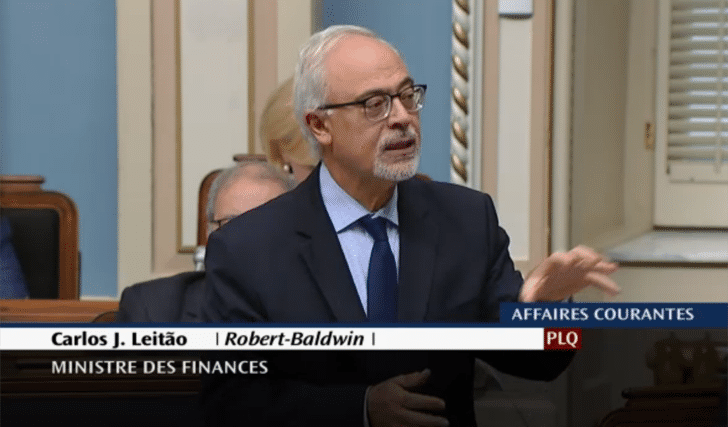

Finance Minister Carlos Leitão has given the Quebec insurance industry some heavy reading with the tabling of a 488-page document containing some 741 articles. Bill 141, An Act mainly to improve the regulation of the financial sector, the protection of deposits of money and the operation of financial institutions, was introduced Oct. 5, 2017. The industry has been expecting the bill since May 2015.

Bill 141 enacts the Act respecting insurers and amends the Act respecting the distribution of financial products and services, in particular to regulate on-line distribution. The Quebec government also intends to abolish Quebec’s Self-Regulatory Organization for financial advisors – the Chambre de la sécurité financière and the Chambre de l’assurance de dommages (an SRO for general insurance agents, brokers and adjusters). The Chambres’ mandates will be given to Quebec financial sector regulator, the Autorité des marchés financiers.This includes ethics control and training. Staff from the Chambres will be transferred to the AMF.

Provisions for segregated funds

Among other things, the Bill replaces the Act Respecting Insurance with the Act Respecting Insurers and "provides for the provisions applicable to the supervision and control of insurance business and the activities of authorized insurers in Quebec", emphasized Minister Leitão in his speech when he tabled the bill. The Act Respecting Insurers also includes provisions for segregated funds.

It allows the AMF "to issue instructions, guidelines and orders, to adopt interim measures of protection, to seek injunctions, to intervene in proceedings concerning the application of this law and to annul contracts or to suspend their execution ".

Online distribution

The Professional Code is being amended in order to regulate the role, functions and powers of the board of directors of a professional order.

The bill amends the Act respecting the distribution of financial products and services to allow firms "to offer financial products and services through technological means."

Among many other changes, the bill also provides better protection for whistleblowers who denounce wrongdoing to the AMF. It also provides for the establishment of an advisory committee of financial product and services consumers.

Commission sharing

The Securities Act is also being amended to restrict commission sharing received by a mutual fund broker or a scholarship plan broker.