The first notable finding in the Canadian Institute of Actuaries’ (CIA) 73rd annual report on intercompany mortality experience – the report says 70 per cent of Canadian individual life insurance is covered by the study – is that the A/E ratio, that is actual deaths to those expected in standard mortality tables, would appear to be climbing.

Bob Howard, independent consultant to the CIA and author of the Canadian Individual Life Experience Updated to Policy Year 2021-2022 – Report says mortality improvement and deterioration can be seen going up and down over the years, but having two or three years in a row with higher mortality is unusual.

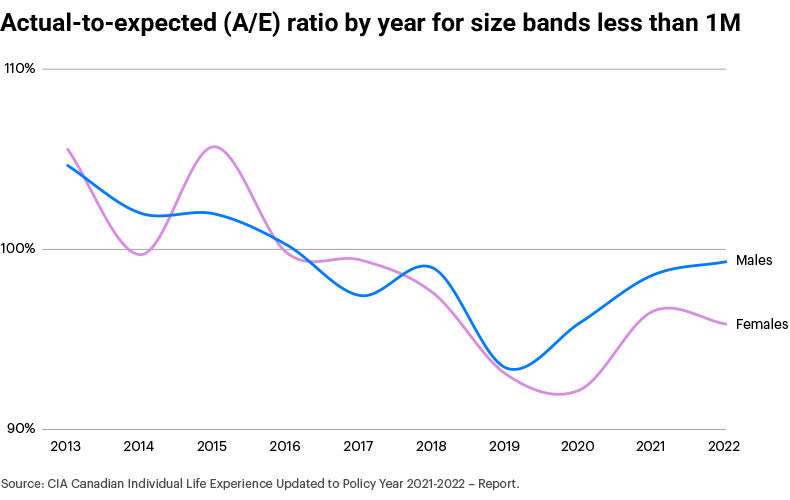

The chart below is probably the one that gives the clearest picture of what’s going on, says Howard. “As the line moves down from one year to the next, that’s mortality improvement. If it goes up, that means mortality deterioration,” he says noting that mortality has come in slightly higher than expected every year since 2019.

“We don’t get too excited when we see one year up and down. The ticks on the page represent one standard deviation above or below what we observed. If you look at the trend from, say, 2013 to 2019, the following couple of years are outside of that trend. That’s a big finding.”

Although unexpected, and likely related to the COVID-19 pandemic, he adds that there may be other factors contributing to the trend, but holds his cards close in that respect: “We need to have a few more years of experience to really be sure,” he says. “But COVID-19 does certainly stand out.”

All that said, he adds that significant mortality improvement in the next year or two could conceivably wipe out this trend. “In which case, there would not be an issue. But if mortality rates stay high, that would suggest that the pricing may have been too optimistic. It would really be too early to make judgement call with respect to pricing or valuation,” he stresses, “but it’s an unexpected finding. It’s something that bears watching. I think you’ll find many actuaries will watch this pretty closely.”

This article was previously published in the October 2024 edition of the Insurance Journal.