The Conference for Advanced Life Underwriting (CALU) has developed a solution that it says would let insurers better meet the needs of insured persons with a reduced life expectancy, who wish to surrender their policy to a third party.

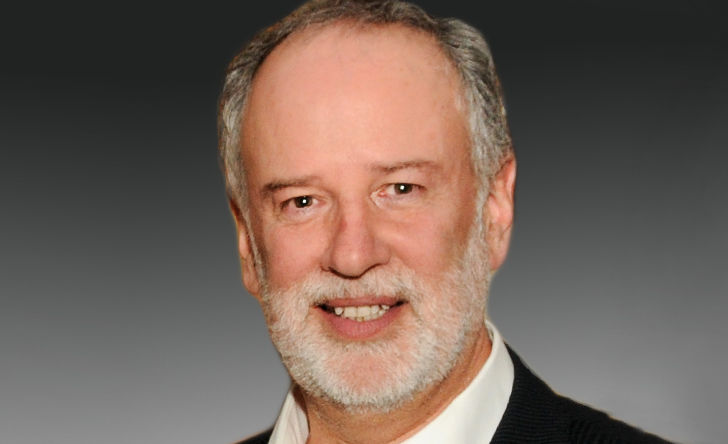

Gilles Chevalier, President and Founder of Engel Chevalier Wealth Protection Inc., explained the CALU approach to The Insurance and Investment Journal in an interview. “Policy holders want a solution. The industry must listen and come up with a win-win solution.”

Not for everyone

Chevalier points out that third party life settlement is not suitable for everyone, that firms are looking for long-standing policies of insured in good health, for a sizable insurance amount, and with no cash surrender value. “Third parties who purchase so-called life settlements are very selective in their target insured profile. One example would be an insured age 75 who has a whole life insurance policy of $250,000, bought at age 45. Very few people fit that pattern. And what about the other insured? We wanted to develop a solution for everyone, not only those who correspond to the prime targets of life settlements. ”

Today, many insurers offer clients whose life expectancy is less than two years an option to receive 25 to 55 per cent of the value of the insurance amount while they are still alive. CALU has thus designed a solution that lets insurers extend the period of life during which compassion benefits can be paid.

CALU is currently waiting for an advance ruling (tax opinion) on its approach from the Canada Revenue Agency. The group will soon have an agreement with an insurer to announce, Chevalier says.

“The insurance companies we met with have expressed interest in this solution. The goal is to make insurance capital more accessible for people with health problems, and extend this period for up to five years, for example,” Chevalier says.

Lapse rate

He also points out that a specific lapse rate is integrated in insurance policy prices. He worries that if the only option in the industry is life insurance settlements, this may drive product prices upwards.

“The advantage of our solution is that it does not change the product pricing structure. It is also accessible to all insured who hold such policies, regardless of the insurance amount,” Chevalier explains.