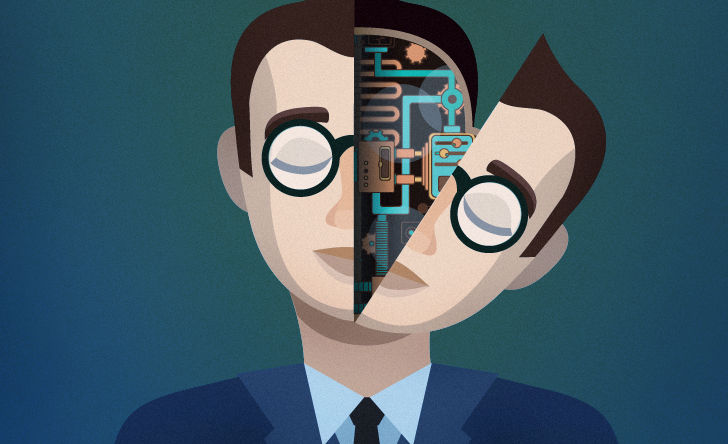

As banks close branches and their services become more commoditized, a study from Ernst and Young (EY) suggests that consumers are looking online for financial products. However, the survey shows that most people still want personal advice and handholding.

EY recently surveyed 55,000 consumers in 32 countries about their banking habits and preferences, including 2,021 people in Canada. The poll reveals that 30% of Canadians and 40% of all respondents worldwide describe themselves as "less dependent" on their bank, and they also report "increased excitement" about the products and services that alternative, financial technology (FinTech) companies can provide.

Better advice and more hand holding

Being digitally literate, however, is not the same thing as being financially literate. In Canada, just 15% of the respondents said they both understand the financial products available to them and are comfortable obtaining them online. EY argues that this points to a need for "better advice and more hand holding through digital channels" than is currently available in the market.

The study also uncovered a preference for personal advice. While 77% of consumers go online first to conduct research, 59% need to speak to someone to get advice or sign up for a new product. Similarly, 66% of Canadians think having a digital presence is highly important, but 60% also believe banks should have a physical presence.

Rethink branch closures

"The findings suggest that closing branches rapidly (which is common in mature markets due to cost pressures and decreasing traffic) may need a rethink," reads the study. "While branch networks do need to be progressively decommissioned in order to address cost challenges and compensate for the rising cost of digital, we foresee a future where branches function differently and assume new formats, such as digital channels with a physical presence or micro-branches in high-traffic locations."

The study finds that most customers want simple experiences, easy-to-understand products, transparency, and around the clock access to products and information. These are all things that FinTech companies are delivering, says EY.

"Across the 32 countries of our study, 41% of customers indicate they would not hesitate to change financial services providers if they found one that offered a better online/digital offer/experience," concludes the report.

An executive summary of the global findings is available on the EY web site.