PriceWaterhouseCoopers (PwC) warns that wealth management firms are falling behind in their technical capabilities.

In a report published earlier this week, PwC describes the wealth management business as "one of the least tech-literate sectors of the financial services industry". The consulting firm argues that if wealth managers fail to adopt digital technology, they will not retain high net worth individuals (HNWIs) as clients, nor will they survive in the medium to long term.

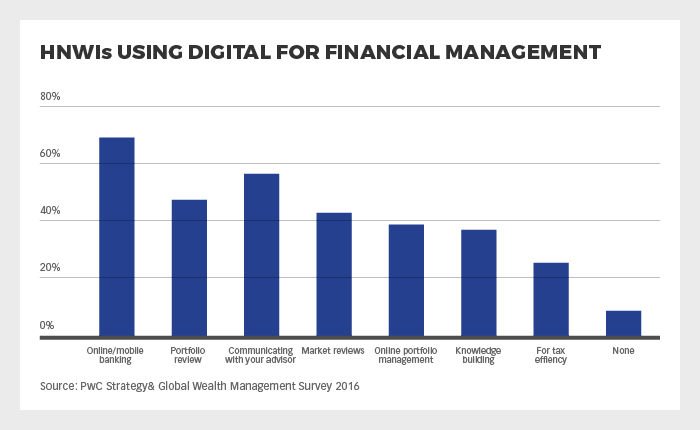

The study, Sink or Swim: Why Wealth Management Can't Afford to Miss the Digital Wave, is based on interviews with high net worth investors, wealth relationship managers, CEOs, and FinTech innovators in Europe, North America, and Asia. It found that wealthy investors are enthusiastic about technology: 69% use online/mobile banking, over half of them believe it is important for their financial advisor or wealth manager to have a strong digital offering, and more than 40% go online to review their portfolio or investment markets.

Early stages of e-commerce

However, the report found that the global wealth management sector is only in the early stages of e-commerce. PwC says that very few wealth management firms have automated and digitised their back office and administrative functions, and that just one in ten use social media with their clients.

"As technology transforms the financial services sector in Canada with the presence of FinTech, wealth management needs a stronger digital presence to provide a greater value for technology-savvy HNWIs," says Raj Kothari, Managing Partner, Greater Toronto, at PwC Canada. "The findings in the global report ring true for the wealth management industry in Canada as we see a younger and more diverse pool of HNWIs in the Canadian market. Building a digital infrastructure informed by them, in order to meet their evolving needs, is required to ensure sustainable growth for wealth management in Canada."