If Donald Trump becomes the next president, it could lead to higher volatility in the markets and a lower loonie.

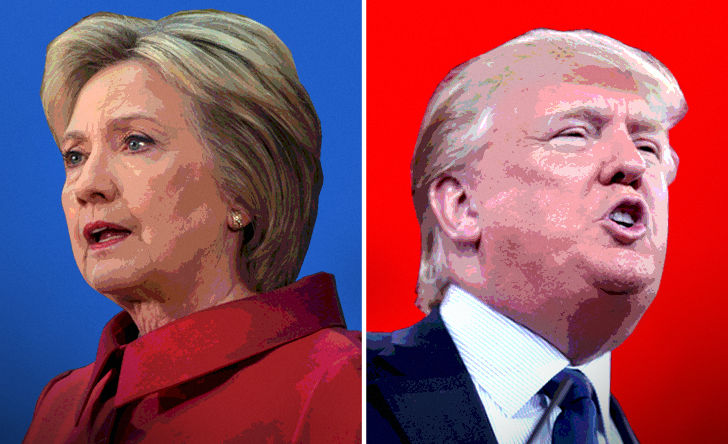

In an investment note posted to the Manulife Asset Management web site last week, head of Canadian fixed income Terry Carr says his firm's base case scenario is that Hillary Clinton will become the next US president on November 8. However, he warns that a Trump victory could catch the markets off guard and heighten volatility, particularly in Canada. Carr points out that Trump has discussed the possibility of renegotiating or even terminating the North American Free Trade Agreement.

“This could have a negative impact on the Canadian economy since the US is its largest trading partner. Under this scenario, we believe the Canadian dollar could weaken against the US dollar. If this were to transpire, it would affect Canadian manufacturers and exporters, which are largely based in Ontario, Quebec and British Columbia," writes Carr. "This, in turn, would hurt those local economies and potentially increase their provincial debt loads."

Carr also suggests that a Trump administration could set off a flight to higher quality fixed income assets. "That could be positive for Canada’s sovereign debt – after all, it belongs to an ever shrinking group of developed nations that has a top notch credit rating and actually offers positive yield," he concludes.