A total of 1205 life insurance advisors from across Canada came together to make the 2016 Canada Sales Congress (CSC) on May 25 a spectacular event. Held at the Allstream Centre in downtown Toronto, a roster of 15 Sales Masters shared their insight and expertise with an enthusiastic and appreciative audience. Jim Ruta, renowned financial industry speaker, author, consultant and CSC Co-founder, was the event’s dynamic Master of Ceremonies.

An event from The Insurance and Investment Journal, the 2016 Canada Sales Congress provided an ideal opportunity for participants to catch up with industry friends and make valuable new contacts.

See below to read their compelling ideas and advice.

David Wm. Brown on hiring a coach 25 years ago and never looking back:

"Although I’ve given him hundreds of thousands of dollars [over the years], he has earned for me millions of dollars. We still see each other. … If you are going to spend any money on anything at this point in time, I believe that going out and seeking a really good coach to work with is really one of the major goals that you should identify."

Helene Meyer on the single goal financial advisors must believe in to be successful:

"I am in the business to serve people and if you put service before reward and people before profit, you will do well in this profession."

Warren Blatt on the importance of drawing on real-life stories to help sell insurance:

"You need to look at the life that you are living, every day, the experiences you have directly or indirectly. Draw on these experiences. This is the meat on the bones. … You are not scaring people, you are just sharing life. Life happens. The result you are looking for, I am pretty sure, will follow from there."

Chris Funnell on selling insurance over the phone:

"I know that many of you think of the phone as the ugly stepchild of selling – second fiddle to face-to-face selling. I understand that. But I find the phone is a very warm, personable and emotional medium where you can connect really well with your clients and prospects."

Denis Bugeja on one of the ways he stays visible to clients:

"One of the things I love doing is sending brownies to client’s children on their birthday. … Think about it: when someone does something unique for my children and makes them feel good, it makes me feel good. And my clients feel the same way: when someone does something for them, even a simple thing…it says: we’re thinking of your child, your family, it has nothing to do with business."

Paul Tompkins on what advisors can do when business is not as good as they think it should be:

"The bottom line is that we all encounter challenges. It’s not all sunshine; there are going to be times when there are lulls and things aren’t happening.… Compartmentalize the issues that are creating that slump. You have to put them off to the side and just get back to basics."

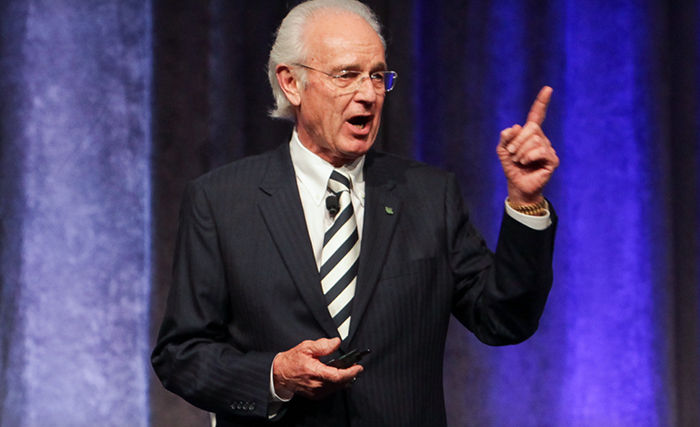

Van Mueller on why uncertainty is great for the insurance industry:

"What are the interest rates going to be a year from now? What’s the stock market going to do? What’s going to happen to the economies of the world? We don’t know any of that [and] that’s exactly why it’s the greatest time ever to be an insurance and financial professional. We give certainty where there is none."

Judy Byle-Jones on ensuring she remains true to the clientele she wants when networking:

"I often don’t take any business cards [with me] and if I do, I may have two or three. One of my standard lines is: ‘my cards are at the printer’s, but please give me your card and I will contact you and continue this conversation at another time.’ … This way, I have control of who I speak to and I have already pre-identified who I am interested in."

Kari Leoganda on the importance of having a strong team in the office:

"Alone you can travel fast, but together you can travel far. And I want to travel far."

Lordy Numekevor on his method of selling insurance:

"I sell insurance with passion because I own it myself. You can never sell anything that you don’t believe in. You can only believe in it if you own it."

He spends $40,000 a year in insurance premiums because he wants to meet the obligations to his family and community.

Zak Goldman on achieving your goals by knowing at the beginning of the year how much you want to earn and then breaking it down:

"I know that I have to sell 30 cases a year with the average premium of $1,600 a month [to meet my goals]. I’m not scared anymore. I have the activity, I know my numbers. … As soon as you know your numbers, you have confidence."

Walter Simone on sitting on eight different boards of directors that give him great opportunities to meet people:

"I never ask for business. But usually when my fellow board members see my dedication, my work ethic and integrity, ultimately they will ask me to look at their or their company’s or their practice’s needs for my professional services."

Aurora Tancock on why many prospects to her retirement and financial planning office are referrals:

"They are not coming in to see me because I have better products, [or that] I can guarantee them better returns: they are coming in to see me because they want someone to help them better organize their finances." When they first call in they are given a checklist to complete before they come to the first meeting. "Our closing ratio is close to 90%."

Bruce Etherington on the importance of patience, building credibility and reliability:

"You want to talk the least about you and the most about your prospects. You must have patience. Each step of the process is like us being put through the client’s filter and if we want to come out the other end pure, you must patiently go through the educational process and the end result will be awesome."

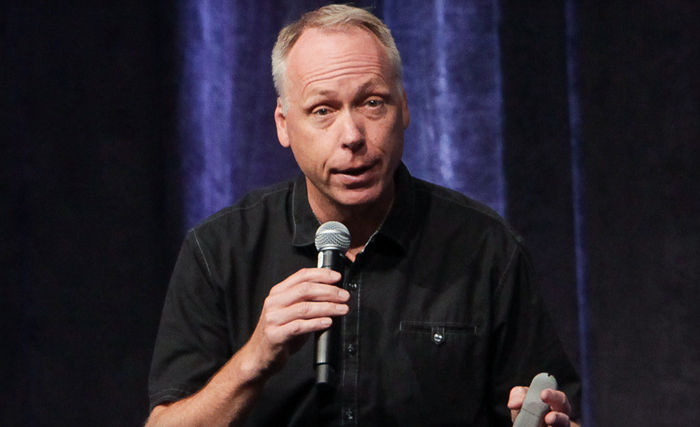

Jeff MacInnis on how challenges make you better:

"Pressure is a privilege. How do you rise above it? How do you push new ideas and new initiatives [to succeed]?"

Jim Ruta on what he learned at the 2016 Canada Sales Congress:

"The lesson is that top advisors sell certainty in an uncertain world because they care for their clients. They position product with passionate questions to help their prospects. Masters work systems to be their best and achieve the most. People buy their energy."