There is a theory, a futurist speaker told a recent conference, that within 45 years there will be a 50 per cent chance artificial intelligence (AI) will outperform human tasks and within 120 years there will be full automation of all human jobs. For the financial services industry, that will translate into the loss of about two million to six million jobs within the next decade.

But not to worry, Nikolas Badminton told the Financial Planning Standards Council conference in November, those figures assume the total destruction of jobs, not the creation of new ones.

“I don’t think jobs will be lost – it will just mean different jobs. It’s about redeployment, not unemployment.”

Badminton said this is not the first time in history that an industry has been turned on its head because of technology, and the financial services sector, now being upended by robo advisors, is no different.

“Robo advisors will absolutely come and disrupt every single person’s job in this room,” he said, adding that by 2020, robo advisors will be able to manage about 10 per cent of global assets. “Now you can play with them and some people might choose to play with them on their own, but really they are going to have to come back to us to work out what has been said within there.”

That’s because many investors still like to have the judgment of a human advisor solidify their investment decisions, said Ajay Agrawal, Peter Munk Professor of Entrepreneurship at the Rotman School of Management, University of Toronto.

“AIs don’t do judgment, they do prediction and that will become an increasingly important point as the prediction parts of our jobs start getting handed over to machines,” said Agrawal.

Judgment is key to determining what investors want to achieve, he said. For financial advisors this means helping clients set their financial goals.

The AI revolution

AIs are better at deciding the approach to reach those goals than most people. What’s holding them back is that they are currently not capable of deciding what goals to set in the first place. “So if you have relationships with clients, a company that rolls into town with a prediction machine is only able to sell you a tool – but they don’t own the action.”

But Agrawal said as AI takes a bigger role in everyone’s daily lives, we will have to adapt to how it does that.

AI is now as revolutionary as the internet was in 1995, except in the case of AIs, the big twist is their ability to predict probabilities. “And that’s what it is, a new form of statistics that happens to be very good at predictions” and is good at analysing all sorts of data, including words, numbers and pictures.

Prediction is a key input into decision making, he said, noting that it will affect those in professions that help clients make the best decisions for their financial futures.

Canada, and particularly Toronto, has become a big participant in the AI game. The computer science department at the University of Toronto has been described as ground zero of the modern revolution in AI. The heads of AI departments at Apple and Facebook, for example, are all from Toronto.

New services

Amazon as well has taken a large place in the AI sphere internationally, where it has been investing in the technology for more than 20 years. Towards the end of 2016, UBS announced it was piloting a new service that lets people ask financial questions to Alexa, Amazon’s AI helper. While it can now only answer pretty benign questions like the definition of inflation and yield curves, the Swiss investment bank’s ultimate goal is to engage a new generation of wealth management customers.

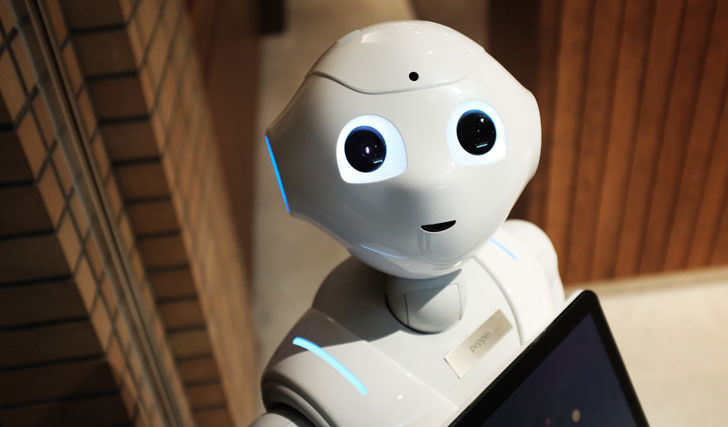

Badminton said people can walk into some banks right now in Japan and South Korea and be greeted by a robot capable of providing advice. Robo advisors there have the ability to process trillions of rows of data and are using that information to suggest ways for people to invest. More importantly, he said, people are discovering that there are some robo advisors that can deliver better returns than human advisors.

Closer to home, Canadian banks are taking an increasing role in robo advice. Most recently, Royal Bank announced it was offering a robo-advisor platform, joining with Bank of Montreal and National Bank in the field.

Currently, robo advisors generally target investors with less than $100,000 of investable assets as their target markets because they can offer investors advice at a much lower cost than traditional advisors.

But human advisors are also being added to robo advice firms. Wealthsimple is currently working with 300 advisors. Last year, the company announced Wealthsimple for Advisors, which lets advisors streamline their practices to focus on investors’ more complicated issues, such as taxes, trust and estate planning.