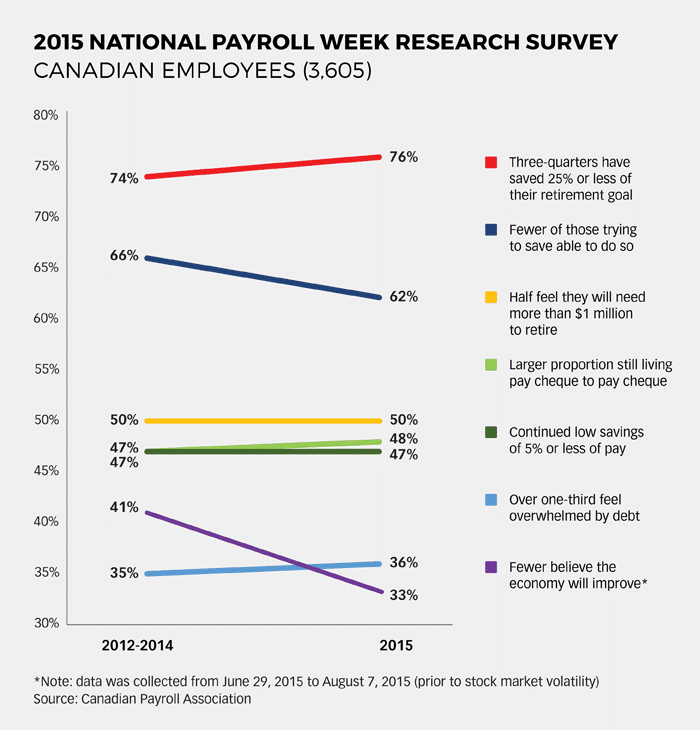

A survey conducted by the Canadian Payroll Association (CPA) has found that many people are short on both cash and retirement savings, with nearly half of the respondents living paycheque to paycheque.

According to the CPA’s seventh annual National Payroll Week Research Survey, 48% of Canadians say they would have a hard time meeting their financial obligations if their pay cheques were delayed by just one week. To illustrate just how cash-strapped some employees are, the CPA points out that 24% of those surveyed say they would probably not be able to come up with $2,000 if an emergency arose within the next month.

The national poll also found that the vast majority of employees are nowhere near reaching their retirement savings goals; three-quarters of working Canadians admit that they have saved 25% or less of their retirement goal, while more than one-third (35%) expect to work longer than they had originally planned five years ago. As for how much longer they think they will need to stay on the job, 21% of respondents said they will need to keep on for at least another four years. Asked why they need to delay retirement, “I am not saving enough money” was the top response, cited by 35% of those surveyed.

Many employees have good intentions when it comes to saving money, with 71% saying that they are trying to put more aside. Actual savings levels, however, continue to be meagre. The CPA survey found that about half of Canadians (47%) are putting away 5% or less of their pay.

Debt is also a cause for concern for many, with 36% of working Canadians saying they feel “overwhelmed” by their level of debt, and 12% of employees saying that they are not sure if they will ever be debt free.