ReMark surveyed 8,000 people from around the world to find out how they purchase and perceive life insurance. The results show that, faced with complex and intangible products, the overwhelming majority of consumers want professional advice.

ReMark International, an insurance marketing company owned by the French reinsurer SCOR, has polled consumers in 14 different countries. These markets, which include Canada, represent about 85% of global life insurance risk premiums and approximately 80% of global GDP. The results show that nearly all insurance buyers want to receive some level of advice when they purchase life insurance, and the number of people who purchase products entirely on their own remains marginal. In fact, the survey found that number of “execution only buyers” has declined slightly, dropping to 7% from the 8% recorded in last year’s survey.

“There are great opportunities to get ahead of the competition for those insurance companies who are willing to tear up the old rule books and engage with customers in a new and dynamic way.”

– Stephen Collins

ReMark divides the remaining 93% of advice-seeking customers into three categories: there are “professional advice buyers” who select advisors according to their qualifications, independence, or fees (50% of customers, up from 38% last year), “traditional advice buyers” who choose an advisor based on a personal recommendation or referral (30% of customers, down from 43% last year), and “guided direct buyers” who buy direct but need significant support during the process (13% of customers up from 12% last year).

“In short, customers value the quality of advice, hence the emphasis on advisors’ qualifications,” reads ReMark’s report. “Our research suggests customers want to make an informed decision but still prefer someone helping them with the (at times, tedious) process of insurance application.”

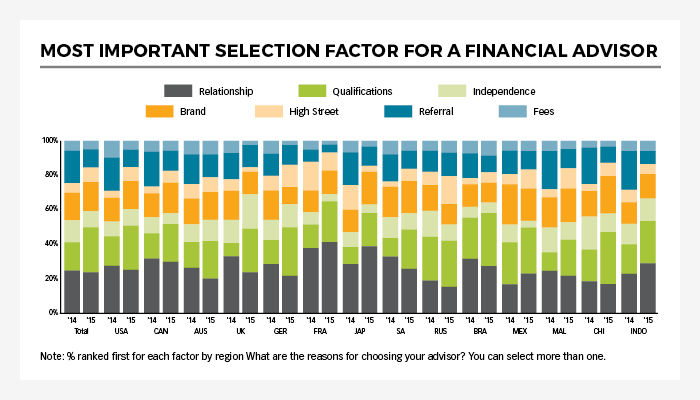

Respondents were also asked to name their single most important fact when choosing a financial advisor. Globally “relationship” was the most important criterion, selected by 25% of those surveyed, followed by “qualifications” which increased to 26% from 17% in last year’s study. In Canada, “brand” came in as the third most important factor, followed by “referral” in fourth place.

ReMark notes that the interaction between factors such as independence and qualifications is becoming more important. The study found that the link between investments and insurance products is a particularly important one; customers often choose an advisor when they are looking for help with their investments, but will later use the same professional to purchase life insurance.

Of the four groups of buyers, ReMark believes that insurers have the most to gain by focusing on “guided direct” shoppers since this group is supported by both regulation and online uptake. “It is also the channel where the existing industry struggles to deliver. This is largely because agency insurers face internal conflict while intermediated insurers are blocked by external channel conflict,” says the report.

Price, product, service, brand

The study found that the relationship between price, product, service, and brand can vary significantly by segment. While true do-it-yourselfers are prepared to sacrifice service in order to get a lower rate on their insurance (despite the fact that the product they receive may not be the most appropriate for their needs), the guided direct customers still value service above cost even though they do not require a face-to-face meeting.

Another area that ReMark examined was how consumers perceive insurance products that have been bundled with investment options. The study found that many clients do not believe they are getting value for their money with this kind of coverage.

“Perhaps the salient point in this type of [bundled] business is that there is limited basis for ongoing customer engagement within these propositions – and almost no scope to respond to changing customer needs,” notes ReMark. “This is particularly the case with bundled products typically sold via bancassurance channels which see high propensity to lapse.”

On the subject of brand recognition, the study suggests that the traditional “one-way broadcasting” style of advertising is passé and not as effective, and that insurers should concentrate on “disruptive strategies” by using social media and technology.

In developed countries, ReMark notes that most people now own smartphones; in the UK, for example, consumers now spend almost twice as long surfing the Internet with their smartphones than they do with laptops and personal computers, and a third of internet users see their smartphone as their most important device for going online.

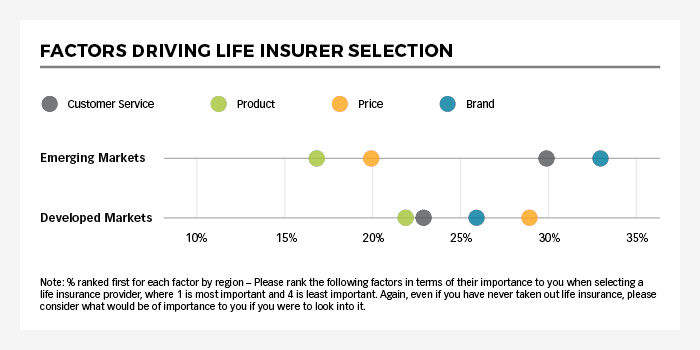

While this widespread technology may end up commoditizing insurance through aggregators and price comparison web sites, ReMark says that brand names remain important to consumers. This is especially true in emerging markets, where there is a lack of trust in regulators.

“Conversely, the relative high degree of trust placed in the regulatory environment of developed markets in particular, leads to an assumption that all brands can be trusted. As a result, customers in developed markets can move to the next level of detail and focus on product benefits and price,” concludes the report.

The collection and use of client information was the final theme discussed in the study. ReMark argues that the life insurance industry has become obsessed with the idea of “big data”, when it really needs to move on and use more smart, relevant data. While insurers can certainly draw useful insights from all the risk, medical, and claims data they have collected, the study claims that a significant amount of ‘white noise’ or ‘irrelevant data’ makes the analysis exercise costly and time-consuming.

Predictive modelling

Instead of focusing on demographic information, insurers should consider how they can collect data that can be used for predictive modelling. For example, new wearable technology allows biometric information to be immediately relayed to the insurer, and may well transform the way the industry measures and prices risk.

Instead of focusing on demographic information, insurers should consider how they can collect data that can be used for predictive modelling. For example, new wearable technology allows biometric information to be immediately relayed to the insurer, and may well transform the way the industry measures and prices risk.

“Wellness programmes, underpinned by real-time data from non-intrusive health and prescription compliance monitoring devices, have the potential to improve the mortality experience of existing policyholders,” says ReMark. “The customer value proposition here is obvious.”

In summing up the findings, Stephen Collins, CEO, ReMark International said, “Our research clearly identifies a growing ‘Insurance Disconnect,’ and demonstrates that the old ways will not work any longer…Customers are demanding change but, with a few exceptions, the industry is deaf to those demands.”

Collins added, however, that “the good news is that there are great opportunities to get ahead of the competition for those insurance companies who are willing to tear up the old rule books and engage with customers in a new and dynamic way. There are some simple actions that companies need to take to align themselves more closely with customers and make new technology an opportunity not a threat.”