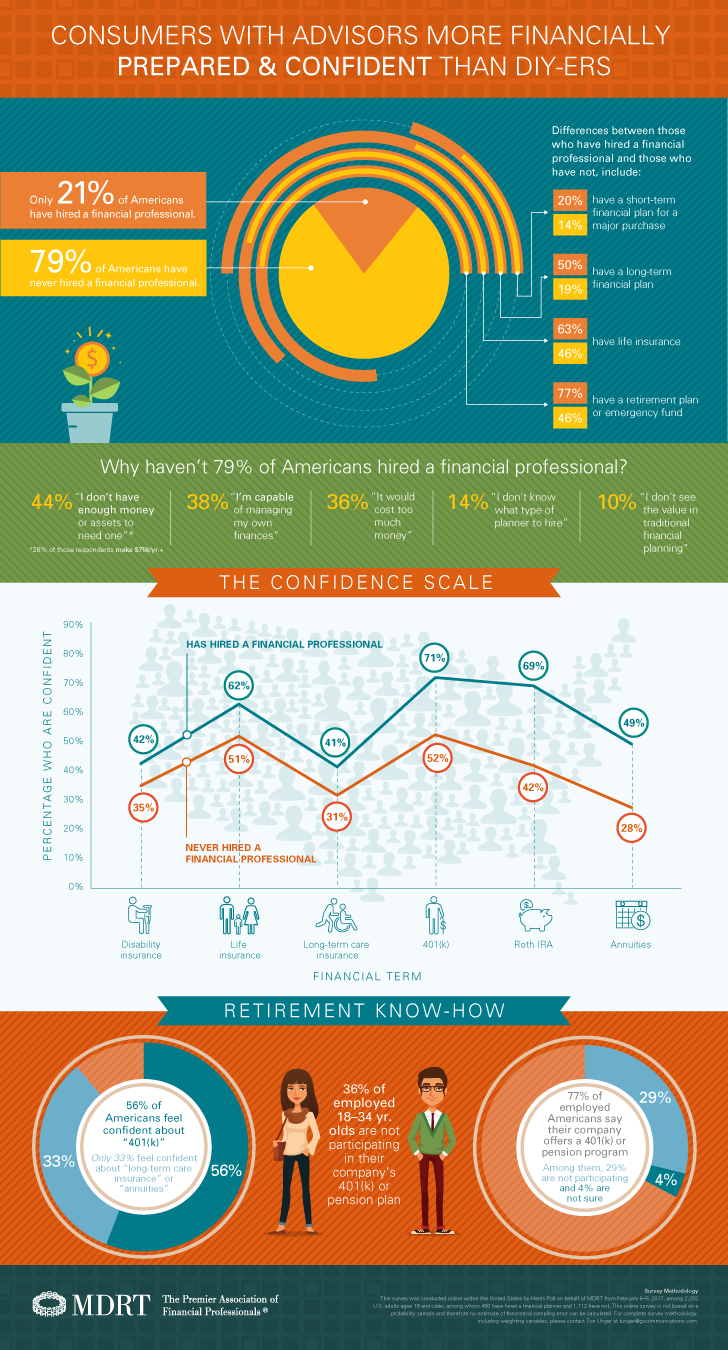

A new study commissioned by Million Dollar Round Table (MDRT) found that 79 percent of Americans have never hired a financial professional, 38 percent of whom say this is because they are capable of managing their finances alone.

However, Americans who have hired a financial professional showed more confidence than do-it-yourselfers with respect to the sight of complex financial terminology. For example, those who have worked with advisors were confident with terms such as long-term care insurance (41%) and annuities (49%), indicates the study, which was conducted online by Harris Poll. The results were announced March 22 by MDRT.

"The importance of planning"

Meanwhile, roughly half of Americans who have never hired a financial professional feel confident with traditional terms such as “life insurance”(51%), however the proportion of those who feel confident seems to drop when it comes to more complex areas such as “long-term care insurance”(31%) and “annuities”(28%).

“These results further emphasize the importance of planning for a healthy financial future,” said Mark J. Hanna, CLU, ChFC, MDRT President. “Consider working with an advisor like hiring a professional builder to renovate your home. While you may be able to paint the walls on your own, your overall knowledge wouldn’t enable you to replace your pipes or build new cabinets in your kitchen.”

Unprepared for retirement

Of the Americans who have never hired a professional, less than half (46 per cent) have a retirement plan or emergency fund, only 19 per cent have a long-term financial plan for the future and 46 per cent have life insurance.

In contrast, the 21 per cent of Americans who have hired an advisor are much better prepared. Seventy-seven per cent have a retirement plan or emergency fund, half have a long-term financial plan for the future and 63 per cent have life insurance.

Why not hire an advisor?

The study asked those who have never hired a financial professional, why not? The reasons given were: they don’t have enough assets or money to need one (44 per cent); they are capable of managing their own finances (38 per cent) and it would cost too much money (36 per cent).

To learn more, view MDRT’s full study results.