Individual life insurance sales enjoyed a double digit increase in the third quarter of 2015 compared to the same period in 2014. Whole life remains the primary source of growth, but universal life is definitely back in the saddle.

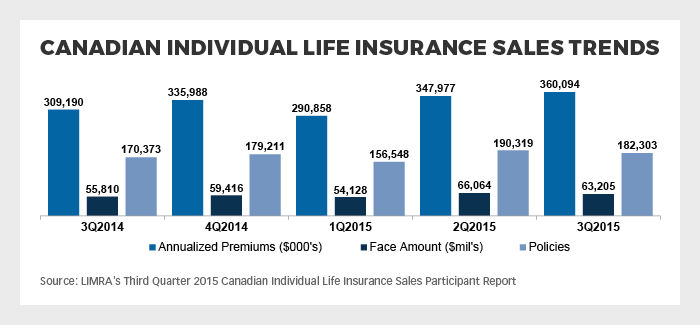

According to data collected by industry research group LIMRA, sales of individual life insurance in Canada as measured by premiums rose by 11% in the third quarter of 2015 compared to the third quarter of 2014. The number of new individual life insurance policies increased by 4% during the comparison period.

Between the third quarter of 2015 and that of 2014, sales of whole life surpassed other products in terms of premiums, growing by 14% compared to the 9% increase posted by universal life and a 5% gain in term insurance.

Whole life garnered 52% of all new individual life insurance premiums in Canada during the third quarter of 2015. Rob Kanehl, head of research at LIMRA, points out that whole life has dominated in this area for several years.

Comparing the third quarter of 2015 to that of 2014, the number of policies sold increased the most in universal life, which was up by 7%. The number of new policies increased by 4% for whole life during this period while the number of term policies sold was up by 3%.

Term coverage accounted for 57% of all new individual life insurance policies in Canada during the third quarter of 2015.

Sales were up across all product lines. These results, however, conceal the fact that only 40% of the reporting insurance providers experienced growth in all three products during the period.

The independent distribution network performed particularly well compared to the captive channel; its sales increased by 13% in terms of premiums while career agencies saw their results go up by just 6% between the third quarter of 2015 and the same period in 2014. According to Kanehl, agents are having less success in selling whole life than they did previously.