All types of individual life insurance products saw similar growth in Q1 2016 compared with the first quarter of 2015, the latest LIMRA report reveals. Overall premium sales climbed by 7%.

Despite the general upward trend, sales growth varied between insurers, says study author Matthew Rubino. “Twelve out of twenty carriers reported overall premium growth, with several citing repricings and new products for their success,” he points out, adding that “Only twenty percent of carriers reported growth across all product lines.”

New premium sales in universal life insurance gained 6% in the first quarter of 2016 compared with the same quarter in 2015. Term and whole life products advanced by 8% during this comparison period.

The number of universal life policies sold edged up 2% during the same comparison period. This increase was 7% for term policies and 12% for whole life policies.

UL slowing down

Pursuing its upswing, universal life insurance is regaining lost ground. “Universal Life (UL) continues to recover from past declines, displaying six quarters of positive growth. UL growth, however, has become progressively slower over the past four quarters,” Rubino says.

Whole life is still a growth driver in life insurance, fuelled by strong participating WL. The study confirms “WL growth reported by eleven of nineteen WL sellers.”

Term insurance also has strong momentum, with sustained sales growth in the last four quarters, he adds. “While not as high as previous quarters, term growth is nonetheless trending upwards, due in part to repricing efforts by several carriers,” Rubino explains.

For some time, whole life insurance has been siphoning new premiums away from universal life. Term insurance gained the same amount at whole life’s expense. “Premium market share shifted slightly in the first quarter, with WL surrendering a percentage point to term since fourth quarter 2015.” Compared to first quarter 2015, UL has dropped one percentage point while WL rose accordingly.

In terms of policies sold, term triumphed in the first quarter, at 56%. Here again, whole life swiped 1 percentage point from universal life.

Rubino found that the gap between the size of policies sold by independent and affiliated agents widened again in March. In terms of amount insured, independent agents’ UL policies sold were triple the size of those of career agents.

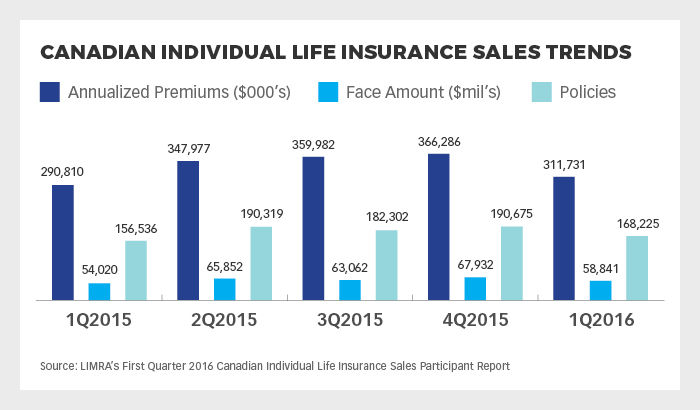

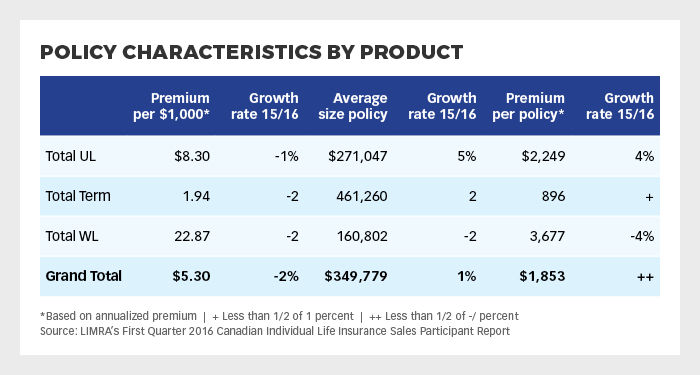

In the industry as a whole, the average insurance amount sold per policy in Canada was $350,000 in Q1 2016, nearly unchanged from that of the same quarter of 2015. Again in Q1 2016, the average annual premium per policy sold was $1,853. Atop the charts, whole life drew an average annual premium of $3,677 at the end of the period, followed by universal life, with an average annual premium of $2,249. Term insurance saw an average annual premium of $896 this quarter.

Career agency network

The career agency network surpassed that of independent advisors in annual premium sales growth. Between the first quarters of 2016 and 2015, career agents advanced by 11%, versus 5% for independents.

Life products generated nearly two-thirds (60%) of career agents’ Q1 sales, compared with 47% for independent advisors by the end of this period. Term products accounted for 28% of career agents’ sales and 27% of those of independent agents. In contrast, universal life sales made up 28% of the total sold by the independent network, versus 12% for the career network.