For some, the latest protracted period of historically low interest rates and international instability has been both frustrating and worrisome.

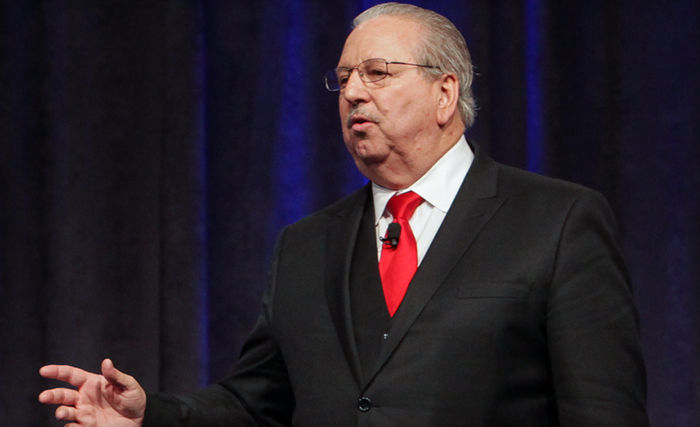

But U.S. life insurance advisor Van Mueller told the annual Canada Sales Congress this spring that the current situations – as disturbing as they may be – offer opportunities for his colleagues in North America like never before.

“If I ask everyone in the audience what the interest rates are going to be a year from now or what the stock market is going to do [do you know]? What’s going to happen to the economies of the world? We don’t know any of that. And that’s exactly why it’s the greatest time ever to be an insurance and financial professional: we give certainty where there is none.”

Van Mueller told the advisors that they should stop trying to tell people what to do with their money, mainly because no one likes to be told that.

Instead, he said, advisors should be turning worried clients into more confident buyers by providing them with products they know will be there for them when they need it or their families can use it.

“You change the world one appointment at a time,” said Van Mueller. “Don’t ever lose sight of it; don’t ever lose the importance of it. You are more valuable than anybody right now. Why? Because you can ask the [right] questions of everybody that you come across.”

Asking those questions will set you apart from other advisors and will help create a strong relationship with the client who may well remain with the advisor for years to come.

Adapt to client’s situation

Uniqueness is also the advice that Denis Bugeja received by a mentor when he was hired on at former North American Life in 1991.

“He insisted on individualism,” said Bugeja, now president of Oakville, Ontario-based DPB Insurance & Financial Services. “Your style, your dress, will definitely set you apart. Basically, every meeting with every client is different; we have to adapt to their situation.”

But more than that, Bugeja insists on staying in front of his clients as often as possible, making sure he is always top of mind.

Some methods work better than others. Some, he said, are quite simple: for example, he sends brownies to his client’s children on their birthdays – not the parent’s. “But think about it,” he said. “When someone does something unique for my children and makes them feel good, it makes me feel good. And my clients feel the same way: when someone does something for them, even a simple thing … it says: ‘We’re thinking of your child and your family’. It has nothing to do with business.”

If he walks by a bookstore and sees a magazine or a book that’s dealing with a subject that he knows will interest one of his clients, Bugeja buys it and sends it to the client. He doesn’t ask clients if they want free sporting event or theatre tickets, he just sends them the tickets. “It has nothing to do with selling, but only about staying in front of your client.”

Building relationships

For Helene Meyer, being top of mind means developing a relationship right from the start, asking the questions of potential clients that will help them solve their problems and determine the kinds of products they require.

“The answers tell me a story that helps me prepare for the first meeting and more importantly, how to manage my client’s expectations,” she said.

Meyer moved to Canada from South Africa and decided to continue her life insurance business here, obtaining her licence, and aiming specifically at women as her target market.

She found opportunities to chat with women who were her neighbours or showed up at the charity where she volunteered – even in elevators. She never asked them to buy insurance from her, but rather asked them if they knew of anyone who was having a “life event” and who might be able to use her services.

“I am in the business to serve people and if you put service before reward and people before profit, you will do well in this profession,” said Meyer, now based in Toronto.

In order to set himself apart from everyone else, Lordy Numekevor learned a technique to keep himself focused – the same method he used when his world came crashing down on him after the death of his father. At the time, Numekovor was nine-years-old and was living in his hometown in Africa.

The power of visualization

“What gets me going is the ability to use the power of my mind to see ahead of me and what I am going to do during the day. When you are able to visualize what you are going to do during the day or even to infinity…all you are doing is finishing the job.”

Now, as president of Numekevor & Associates Inc. based in Cambridge, Ontario, he stays in front of his current clients by putting out a newsletter twice a year – and a client is always on the front page.

Potential clients receive Numekovor’s “soft sell” on different kinds of insurance.

“I don’t talk about key man insurance; I talk about business stabilization insurance,” he said. “I sell insurance with passion because I own it myself. You can never sell anything that you don’t believe in. You can only believe in it if you own it [yourself],” said Numekevor. He noted he pays premiums every year because he wants obligations to family and community to be met both here and in Africa.

Constant contact

Some advisors, like Walter Simone, are constantly in touch with clients. In fact, Simone said he has been on the phone with clients while standing on the Great Wall of China and from the Serengeti Desert in Kenya.

Like others, Simone does not discuss business outright. Simone, president of Simone International Insurance Services Inc. in Toronto, has made many connections sitting on the myriad boards of directors or organizations that represent his different interests. “I never ask for business. But usually when my fellow board members see my dedication, my work ethic and integrity, ultimately they will ask me to look at their or their company’s or their practice’s needs for my professional services.”

Simone said he also believes certain personal traits have helped him stay in front of his clients – characteristics like punctuality. He said unless a client calls him to tell him otherwise, he only waits 15 minutes for that client to show up at a scheduled meeting. “Soon you will get the reputation that you are never late and you don’t wait.”

He also believes in integrity and the importance of keeping up with the industry, said Simone, who has 10 designations and is working on three others.

Providing solutions

For his part, Paul Tompkins, president of Toronto-based Tompkins Insurance Services, grew his business by writing articles, giving seminars to groups of mostly lawyers and accountants and giving back to the community.

Now totally focused on life insurance and working exclusively with high net worth clients, Tompkins said he provides “solutions” to people’s problems.

“I don’t believe there is any secret sauce; you have to know the products you’re dealing with, you have to know your own market, you have to know your unique skills.”

New advisors will inevitably face highs of great selling times and lulls when there seems to be an undue number of rejections.

“Compartmentalize the issues that are creating that slump,” he suggested. “You have to put them off to the side and just get back to basics.”

Another way to set yourself apart from other advisors is to tell your own personal stories, whether successful or not, said Warren Blatt, insurance and risk management specialist with Toronto-based WDB & Associates.

Blatt said he was in his family business in 2005 when it went bankrupt, planting deep seeds in him on the importance of thoughtful succession planning.

Massive opportunity

“Business and succession planning is one of the most untapped and untalked about areas in business and insurance,” said Blatt. “It is a massive opportunity right now. You hear about it all the time. So I thought: who better to tell about it then a son who lived through the unfortunate results of a faltering business and an owner with no contingency plan.”

Blatt said he has only “sold” one insurance policy in his life – and that was critical illness insurance for his wife, who was diagnosed with stage 3 melanoma in October 2014. While the cancer was caught in time, the time he took off work to be with his wife had an impact on the amount of income he could bring into his family.

He told the advisors at the conference that while all of them are qualified to sell, it’s the kind of approach they have with clients that will make them unique.

For his part, he draws on his personal life to tell the real stories of the need for different kinds of insurance.

“Draw on these experiences. This is the meat on the bones. Deal with them and share them. You are more qualified to tell these stories than anyone next to you. These are your stories. People will accept you and will believe you and will make you an integral part of the plan. You have identified with them. You are not scaring people, you are just sharing life. Life happens. The result you are looking for, I am pretty sure, will follow from there.”