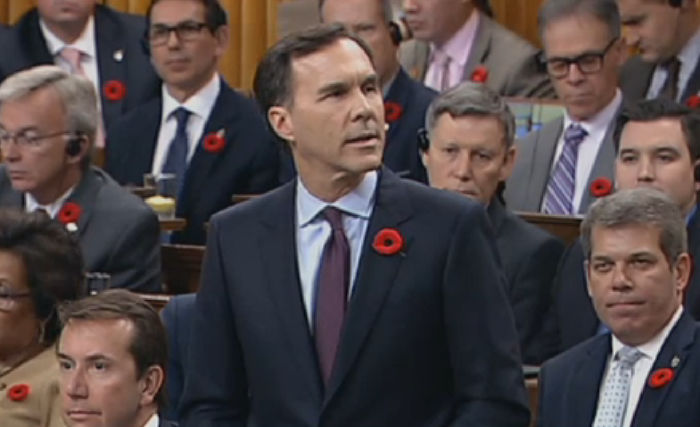

Finance Minister Bill Morneau presented the federal government's Fall Economic Statement yesterday, outlining plans to invest more money in infrastructure. The announcement met with approval from Canadian insurers.

The federal government intends to take advantage of low interest rates and put $81 billion into public transit, green and social infrastructure, and transportation infrastructure that supports trade.

Institutional investors also want to invest their capital in assets that provide stable, long-term and predictable returns, and the economic statement argues that "there is no investment opportunity that fits this description better than infrastructure". This being the case, government is creating the Canada Infrastructure Bank, a which will work with various levels of government and the private sector to fund large infrastructure projects

"A true win-win"

"It is a true win-win — delivering the solid returns that seniors need for a secure and dignified retirement, while building even more of the infrastructure the next generation of Canadians needs to succeed and prosper," reads the statement.

The Canadian Life and Health Insurance Association (CLHIA) welcomed the news. “We are very hopeful that the new Infrastructure Bank will focus on a range of projects with varied size and scope so that all provinces and municipalities across the country can benefit," said the CLHIA president and CEO Frank Swedlove. "Canada’s life and health insurance industry stands ready to play a major role in building our infrastructure.”

CLHIA points out that the Canadian life and health insurance industry is one of the country's most important sources of long-term capital and holds close to $700 billion in long-term investments.