At a time when a company’s brand can be measured by the reputation it has on social media networks, many industry players have a significant online presence. The Insurance and Investment Journal has taken a tour of this universe.

It is difficult to develop a company’s reputation today unless it has at least a limited presence on social networks. These new areas of development are not only transforming customer relationships and generating new business opportunities, but they are also fundamentally changing the way companies handle their communications.

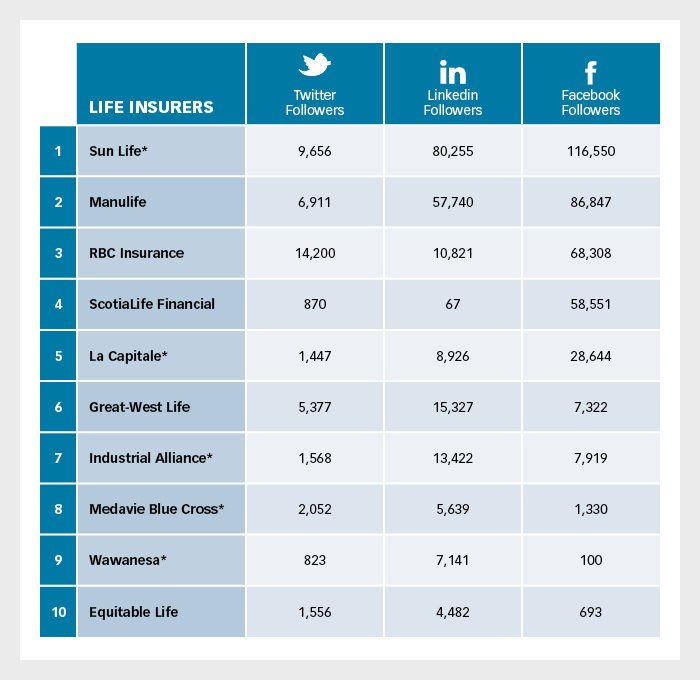

Canadian life insurance companies have understood this and are showing an increased presence on social networks. Of the 18 life insurers surveyed, 89% are present on Twitter, 72% are on Facebook, and 100% are on LinkedIn. The life insurers included in The Insurance and Investment Journal’s study collected an average of 12 906 people on Facebook, 7817 on LinkedIn, and 2683 on Twitter.

Among advisors, however, the situation is quite different. While they face the same issues when it comes to customer relations and visibility with the general public, most have yet to make a significant investment in social media.

Study methodology

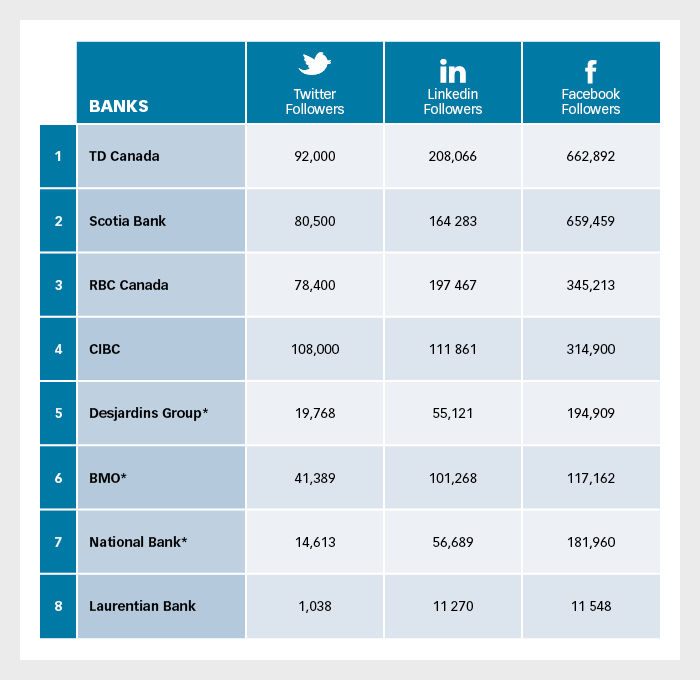

For the rankings above, The Insurance and Investment Journal team used numbers gathered as of March 1, 2016 from various social networks. The numbers of subscribers listed on Twitter, Facebook, and LinkedIn were then added together to obtain an overall audience. It is the latter number that has been used to obtain the different rankings.

Note that to be included in the Top 10 / Top 8 rankings, the various organizations (insurance companies, banks) must be present on at least 2 of the 3 major social networks.

Furthermore, for the companies that have pages in French and English (represented by the symbol *), we added together the numbers of registered subscribers.