FHG also acquires Groupe CMA

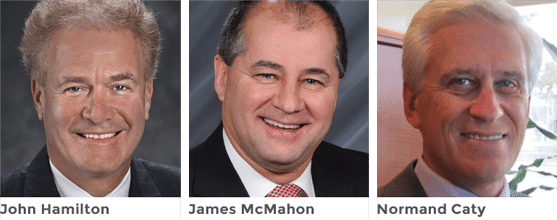

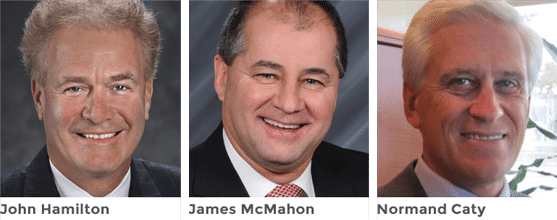

One of Canada’s largest life insurance managing general agencies now intends to make itself a player in the mutual fund distribution business. Financial Horizons Group (FHG) has acquired Excel Private Wealth and Certika Investments Ltd in two deals revealed John Hamilton, president and CEO of FHG in an exclusive interview with The Insurance and Investment Journal. FHG also announced the acquisition of Groupe CMA.

The transaction to purchase Excel Private Wealth was completed on June 1. Certika was purchased as part of its acquisition of R.G. Packman & Associates group of companies. FHG plans to keep the Excel Private Wealth brand and eventually merge Certika into Excel. James McMahon, CEO of Excel, will continue to run the operations of the company. McMahon has been president of FHG’s Québec Division since he sold his MGA, Force Financiere Excel to FHG in 2012.

Hamilton expects that FHG’s decision to enter the mutual fund business will be well received by advisors. “Advisors have been asking us for a platform for the money business and we are excited to finally offer one to them.”

With these two acquisitions, Financial Horizons will have about $2 billion in assets under management in the Quebec and Ontario markets. Hamilton says FHG is currently in talks with several other mutual fund operations to potentially expand this business across Canada. The target is to reach $8 to $10 billion AUM. To be profitable in mutual funds, he adds, “You can’t be a small player.”

In previous transactions, FHG acquired the life insurance businesses of Excel and R.G. Packman, but was not ready until now to acquire these companies’ mutual fund operations. Why the change in strategy? Hamilton says he was never against adding a mutual fund platform to FHG’s operations, but did not want to do it until he could do it right. The goal he says is to “get more completely rounded” as a company and offer advisors an opportunity to bring their funds business to FHG if they so choose. He underlines that FHG will not be aggressive about pursuing the mutual funds business of the dual-licensed advisors who currently place their life insurance with the company. He roughly estimates that about 30% of its advisors (about 3,000) are dual-licensed.

FHG has chosen to maintain the Excel brand over using the Financial Horizons name for a simple reason. “We like the name Excel.” It also helps that it is a well known and respected name in the Quebec market.

Groupe CMA acquisition

Also today, Hamilton announced the acquisition of 100% of the shares of Groupe CMA. This transaction is expected to close in October 2015. Normand Caty, CEO of Groupe CMA will join FHG as executive vice president, Québec Division. Groupe CMA’s group savings plan branch had already merged with Excel Private Wealth in 2013. “Our acquisition of Groupe CMA will strengthen our position in the Quebec market,” says Hamilton. “We will be bigger, stronger and better performing.”

With these latest acquisitions, FHG now has an advisor force of almost 9000. It has new life premiums of “north of $40 million” and total segregated fund assets of about $7 billion, making the company one of the top two largest MGAs in the country, depending on what you are measuring, says Hamilton.