LIMRA results for Q1 2016 show a surge in CI insurance sales for both new premiums and number of policies.

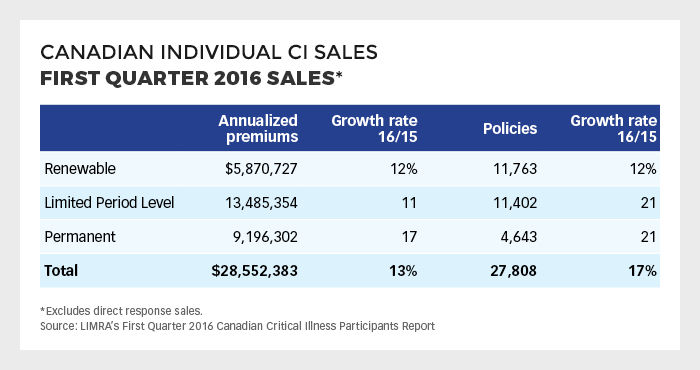

In the first quarter of 2016, insurers in Canada sold 17% more CI insurance policies than in the first quarter of 2015, the latest LIMRA report confirms. New premium sales were 13% higher at the end of the comparison period.

In an exclusive interview with The Insurance and Investment Journal, Karen Terry, assistant managing director - Insurance Research at LIMRA, describes the results as spectacular. “It’s been a great start for the year. All products and the two tiers of the carriers are up in the double digits. That’s unique,” she says.

Competitive pricing

This rise is fuelled by several factors. For one, the first quarter of 2015 was weak, and it was easy to grow from there, Terry notes. “Some carriers mentioned more competitive pricing and others introduced new products,” she continues.

Terry foresees continuing strength in critical illness insurance sales this year. “We’re hoping that the growth continues. No indicators are telling us otherwise.”

These trends are promising. Suppliers told LIMRA that they are stepping up their efforts to market critical illness insurance products.

“Carriers told us that they want to increase the focus on CI products, in an environment a little bit more challenging for UL and other products more sensitive to low interest rates. This brings more potential for simpler and more protection-oriented products,” she explains.

However, no insurers announced plans to launch new CI products in 2016. “Carriers will be spending a lot of time and resources on the new regulations and the exempt test changes,” Terry points out.

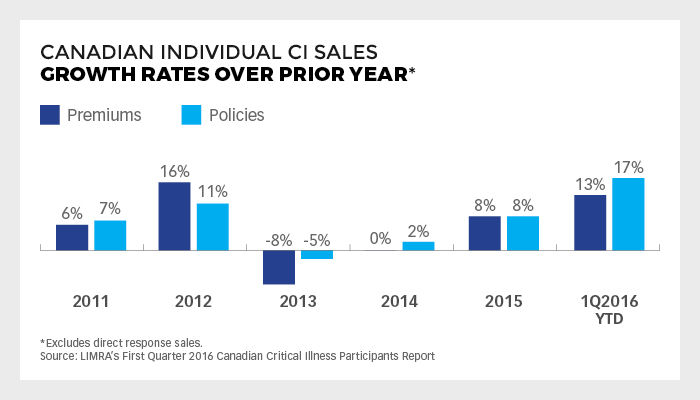

The upturn that followed the price hikes of 2012 was more than a flash in the pan. “There’s been a turnaround since 2015, and CI sales continue to build on it,” she says.

High prices hobbled guaranteed product sales, and had a more modest effect on limited period level. After negative sales in 2013, critical illness insurance stagnated in 2014.

Between the first quarters of 2015 and 2016, all products regained momentum. In fact, the permanent product, hit hardest by price hikes, made the strongest comeback. During the comparison period, new premium sales for permanent climbed 17%, versus 12% for the term product (unaffected by the higher prices) and 11% for limited period level. The permanent product thus drove one-third of sales in the first quarter.

Terry reports that all networks saw growth in critical illness insurance sales. Sales in the independent network soared by 18% in Q1 2016 compared with the same quarter of 2015. “MGAs reported the highest growth of all the independent channels,” Terry says. During this time, the career network saw a 6% increase.

Independent network

The independent network cornered 63% of all critical illness insurance premiums sold in the first quarter, versus 58% at the same time last year. LIMRA cites the permanent product as the growth driver for independents. This network achieved growth of 27% in its permanent product sales. Term was the star product for the career agent network, with sales up by 13%.

After emerging in Canada in the mid-‘90s, the critical illness insurance market has swelled to $826 million in premiums in force, an 8% rise since 2015. Today, policies in force total 760,000, for growth of 9%. Sixteen companies participated in the survey. Terry says they represent the vast majority of the market.