Successful financial advisors are often those who pick a niche market or product line to create value for their clients.

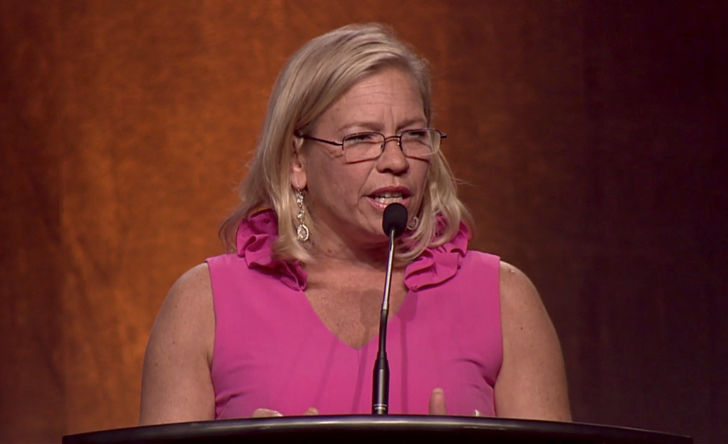

Take Léony deGraaf Hastings, for example – a second-generation life insurance agent who watched as her father, a top producer, instilled in her the sales principle of “see the people, see the people.”

But deGraaf Hastings didn’t want to be a “salesperson,” disliking the feeling of being sold to. So she shifted her focus from selling to educating her prospects. “I had a whole new perspective,” she told the Canada Sales Congress held last May.

The first passion for the Burlington, Ontario advisor was critical illness insurance after her mother developed breast cancer. DeGraaf Hastings learned everything she could about every CI product, developed her elevator speech and introduced the idea as often as possible.

Working with seniors

At first she did well, but soon discovered that many of her prospects either couldn’t afford CI or failed the underwriting for the product. When her mother passed away, deGraaf Hastings set her sights on a growing demographic – seniors – fuelling a new desire to help people simplify their estates.

In 2004 she earned her Elder Planning Counselor (EPC) designation and dove into the seniors’ community, working with various groups, including senior crime and fraud prevention.

She put together a series of educational presentations for seniors, marketing them to retirement homes in Burlington to fill their activity calendars with educational topics. She offered age-appropriate draw prizes to encourage attendees to fill out their ballots with their contact information and followed up with them promptly.

A few months after opening a mall office, the global financial crisis came crashing down – but seniors’ beneficiaries were kept whole because their relatives had purchased segregated funds.

“During this time, I was laser focused on building my brand, conducting more seminars and advertising in a local seniors’ magazine while volunteering to write articles for them.” She spoke to thousands of seniors, addressed their concerns, learned what was important to them and what kept them up at night.

In doing so, she crafted strategies that allowed her to find a new market – the second generation.

“Together we have set up legacies that will last for generations and ensures that I will continue to work with their families after they become angels,” said deGraaf Hastings.

Bhupinder Anand

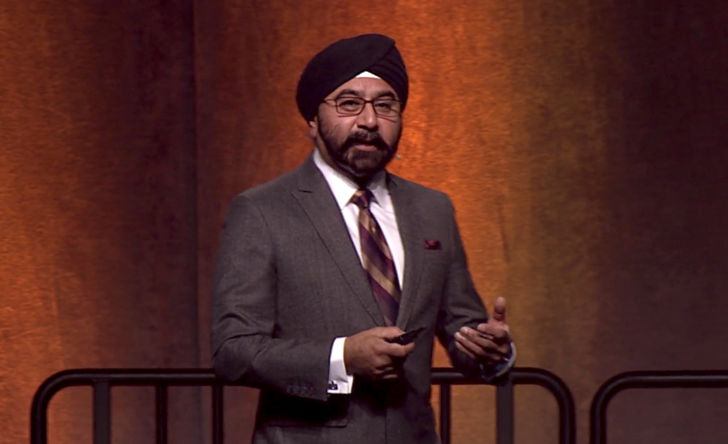

Creating value is nothing new to advisors in the United Kingdom, said Bhupinder Anand, managing director of a firm of independent financial advisors in London.

Advisors there had to learn to create new value propositions for their clients following the introduction of a series of advisor rules, known as Retail Distribution Review, in 2012. Basically, the rules removed embedded commissions and boosted qualifications for financial advisors.

“The stuff we have been through in the UK has been painful, very painful,” said Anand. “It has forced many people out of this great profession; it has changed the way we behave, it has changed the way we make our money and the way we charge our clients.”

High net worth clients

As a highly paid fee-based advisor in the UK, Anand said he has learned that most successful advisors have a target market on which to focus. For him, it’s only high net worth clients.

Value, said Anand, has nothing to do with money. Rather, value stems from the knowledge advisors bring to the table to help their clients.

“[It’s] what we are doing for our clients that they either cannot or will not do for themselves. If we know the answer to a question…then we are creating value.”

Anand breaks down his business model into four areas: fact finding, research, presenting the ideas and following through with implementation. “It’s about positioning your value in the first place. How you get paid is a different story.”

But he did say that getting paid is an important part of the transaction and cautioned advisors at the Toronto conference from giving away information for nothing.

“Create value the very first time you see a client,” he said, adding that advisors should never say the first meeting is free or no cost. “If you say something is free, what value does it create? Nothing – a big fat zero,” said Anand. “So next time you make your next appointment, say ‘the first meeting is at my expense’.”

Toronto-based Jerry Wiseblott makes no bones about the fact that he is treating at the first meeting – usually over breakfast or lunch.

Life and P&C insurance

Wiseblott sells both life and property and casualty insurance. While much of his business comes from repeat clients, he meets with four prospects a week, initially at a restaurant or café.

“I figured it out – everyone has to eat and everyone likes a free meal. So four times a week I make appointments with prospects and have lunch or breakfast. I get these individuals out of their offices [to a place] where there are no distractions and I get to know them.

“Throughout the conversation, I don’t even bring up the word ‘insurance’ but if they mention it, they’re fair game.” Wiseblott said even if they don’t buy from you, he’s discovered prospects are sure to send him a referral or two.

Wiseblott’s list to create value includes:

Position yourself – schmooze: you must meet people face-to-face. Get involved in your club or charity. Whatever the membership costs, you will earn 10 times the commission in the next five years.

Customer service: be personal and caring if you want to be in the relationship business.

Make a list: before he leaves the office he creates a list of the people he will call the next day between 10am-noon and 5pm-6pm. “You have to have great habits calling and asking for referrals and appointments. This has to be repetitive.”

Have a team: you can’t do it alone. You don’t have to specialize in everything, but you do need to be able to go to a few different companies that you trust to provide the products, the pricing and service element.

Be customer-centric: build your practice around the needs of your client.

Lianne Pereux of Pereux Financial Services had no idea that while she was working as a social worker she was creating value for herself in a future insurance role at her father’s Winnipeg-based MGA. The emotionally draining position in addiction and mental health took its toll and she turned to Daystar Financial (acquired by HUB Financial in 2013), wrote her LLQP and, at her father Rene’s insistence, put together a list of at least 100 names for prospecting.

“My first week I had five appointments and I wrote five life applications. I was told this was a pretty good start to selling life insurance. My first year I wrote 95 life and health applications, which I was also told was a pretty good start to the life insurance industry.”

Trusting relationships

Pereux said it all worked out because she had learned the necessary skills to create the value of engaging clients in trusting relationships when she was in social work.

“If you think about it, what do [social work] counsellors do with their clients? They ask questions, they listen, they have difficult conversations, they help clients set goals, they motivate clients to take action to make changes in their lives.

“We are in the business of people, not products. The products are secondary to what we do. What we do is create meaningful and trusting relationships with people who are in need of our products because they help protect their families, their businesses, their legacies.”

Rene Pereux, president and founder, Pereux Financial Services, said one undiscovered niche is the younger generation. A 2013 LIMRA study indicates the average Canadian life insurance advisor sold 7.2 applications that year, the lowest level of life insurance ownership by Canadian households in 30 years.

He said an Ipsos Reid study in 2016 shows that 70 per cent of Canadians have never even been solicited by a broker or an agent.

While Pereux acknowledged that the drop in purchased life insurance policies is in line with the demise of most career agencies in favour or independent advisors using managing general agencies (MGAs), he said most people don’t buy life insurance because it’s not on their to-do lists.

“The biggest reason I believe [for people not buying life insurance] is because it’s an unaware sale,” he told the conference.

His daughter Lianne Pereux said she sees this is a fabulous opening for younger advisors. “The interesting thing for my generation of advisor is that no matter what market you work in, pretty much everyone you meet is a prospect because no one has approached them. Eighty per cent of my clients had never been approached by an advisor, have never owned personal life insurance and wouldn’t even know where to get it if they weren’t meeting with me. What an incredible opportunity to sell life insurance if we are just willing to ask.”

Rene Pereux offered up some suggestions on how advisors can turn prospects into clients:

When attending a meeting with a prospect:

- Sometimes two heads are better than one so take someone from the office with you.

- Always put together an agenda for the meeting.

- Summarize everything that was discussed at the meeting and send the notes to the client.

- Have someone who knows everything there is to know about compliance on staff.

- Get the latest on what’s going on in the industry by joining an organization such as CALU.

- Focus: Keep a list of every prospect, every case you have opened up and every case currently being underwritten. The list shows the revenue they will generate “just for a little more motivation.”

Greg Pollock, president and CEO of Advocis, said creating value has to do with giving your clients choice – not only in the advisor they choose but how they pay.

Embedded commissions

Wading into the embedded commissions debate, Pollock said Advocis has created a campaign called Financial Advice for All, which he said will send a message to regulators that clients be allowed to have a say in how they pay their advisors.

He called the CSA’s proposed plan to ban embedded commissions across mutual funds as being “just the beginning from our perspective. We believe this is wrong-headed, it’s ill-conceived and will hurt the vast majority of average Canadians across this country.”

He invited advisors, their clients and their families to take part in the Advocis online campaign by going to www.financialadviceforall.com.

“Together, we can stand up and protect the future financial security of all Canadians.”