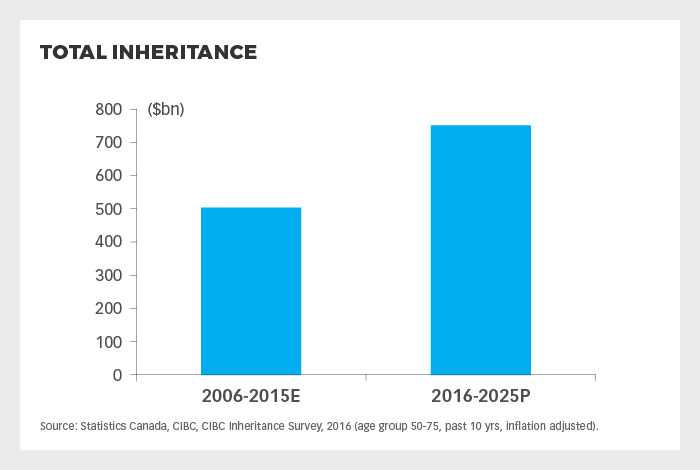

Over the next decade, CIBC Capital Markets has calculated that Canadian baby boomers will inherit about $750 billion.

In The Looming Bequest Boom, CIBC Capital Markets chief economist Benjamin Tal says that Canadian boomers are about to benefit from the largest transfer of wealth that has ever taken place. His research reveals that there are currently 2.5 million people in Canada who are over the age of 75. This number is expected to increase significantly over the next decade, when this age group is expected to become the largest and wealthiest it has ever been with an estimated net worth of $900 billion. Eventually, an estimated $750 billion will make its way into the hands of the baby boomers.

The report says that a little more than half of those currently between the ages of 50 and 75 have received an inheritance, and about half of them received it in the past decade. The average inheritance was $180,000, and the study found that 40% of wealthy individuals either saved or invested their inheritance, while a larger proportion of lower income Canadians used the money for daily expenses.

Tal estimates that the coming transfer of wealth will boost the asset position of Canadians 50-75 years old by no less than 20%. As for the effect this transfer of wealth will have on the Canadian economy, much depends on how it is used. Tal says an inheritance may prompt some to increase their spending and save less, while others may drop out of the workforce and start their own businesses. Still others may give the money to their children, which could increase home ownership rates among younger Canadians.

These inheritances, however, are unlikely to prompt a massive wave of retirements. “Based on research done in the US, the average inheritance increases the probability of retirement by only 3%, and the impact on retirement security is statistically significant, but relatively modest,” concludes the report. “We have no reason to believe that the situation in Canada is very different.”