Life insurance agents are retiring and consumer preferences are changing. Will large retailers or technology companies like Amazon, Apple, and Google be the ones who provide the middle-market with life insurance?

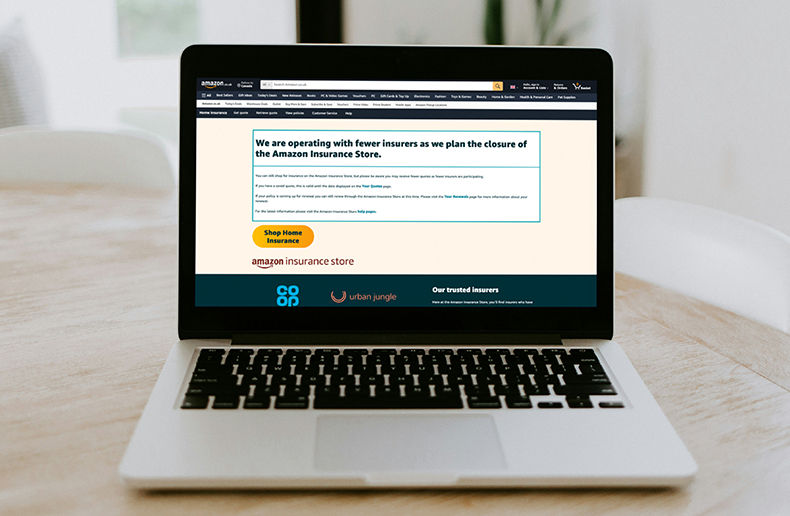

In a recent report on life insurance and annuity distribution trends in the United States, ratings agency A.M. Best notes that domestic insurers are starting to see competition from alternate channels such as affinity groups, retailers, and online comparison platforms. While Walmart is only selling automobile and health coverage at the moment, Costco and the American Association of Retired Persons (AARP) have started to offer a larger suite of products, including life insurance.

In Shifting Dynamics Could Lead to Distribution Channel Innovation, which was published on December 6, 2016, the ratings agency points out that Amazon, Apple, and Google all have strong balance sheets, large databases of customer information, superior technological resources, and a significant amount of excess capital. If they were to decide to get into the insurance business, the report suggests they could disrupt the traditional distribution model.

Extensive data mining capabilities

Online retailers have neither a sales force nor experience selling life insurance, but they do have extensive data mining capabilities. Given their strong brands and loyal Millennial customer base, A. M. Best suggests these large, high-tech corporations could access the middle market more efficiently than traditional life insurers; they would probably begin with simplified products that are better suited to online buyers.

As consumer preferences change, the report argues that the insurance industry in general will shift towards using the internet for direct sales and as a first point of sale. Within the next five years A.M. Best points out that Millennials will make up about half of the US workforce and they expect to buy insurance the same way they purchase other products. “Insurers are going to have to figure out a way to offer this kind of customer experience in order to penetrate this growing segment of the population,” reads the report.

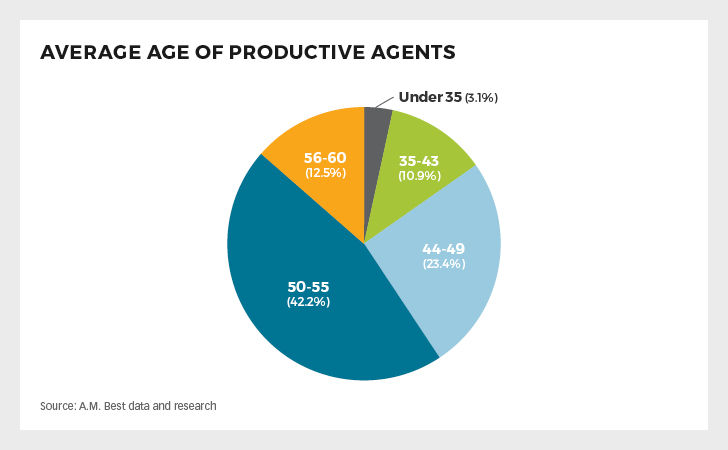

What’s more, there is a “pending retirement wave” of life insurance agents and a lack of new recruits to the business. A.M. Best warns that as the older generation leaves the industry, there may not be enough younger advisors left to provide the mid-market client with individual, face-to-face service.

“There is broad consensus that the distribution system for the life insurance industry must undergo a rapid, strategic evolution based on changing demographic and macroeconomic conditions. The structure of basic customer relationships, the core value propositions of products, and the role of agents in broader and diversified distribution models are all ripe for change,” concludes A.M. Best. “The industry is altering how it identifies potential customers; what it sells to them; and how it sells, services, and distributes those products. This is a big undertaking for an industry that is mature in nature with historically slow rates of adaptation.”