Insurance company executives know that digital solutions are needed to improve the customer experience and business operations. New survey data from research firms Capgemini and Efma, however, shows how much the industry is playing catch up: Only 26 per cent of Gen Y customers, and only 26.3 per cent of tech savvy customers in Canada say their insurance industry experience was a positive one.

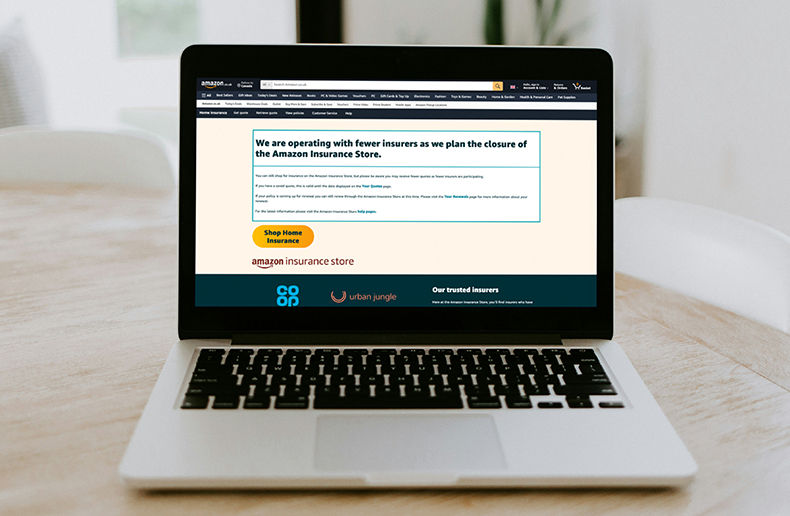

The 2018 World Insurance Report further shows that challenges lay ahead as big technology (BigTech) firms like Google and Amazon make insurance industry advances and consumers show a greater willingness to obtain their coverage from non-traditional sources. Compared to just 12.1 per cent of those surveyed in 2015 who said they were willing to purchase insurance from a BigTech firm, that number has risen sharply in Canada to 22.8 per cent in 2018.

Restrained by legacy systems

“Relatively lower positive experience across all demographic segments indicate that insurers have not been able to keep up with the fast rate of evolution of customer preferences and expectations,” say the report’s authors. “Tapping into the latest technologies without being restrained by legacy systems is a key next step for insurers to ensure an enhanced and positive experience for all customer segments.”

They say although insurance customers in Canada rate traditional channels highly (traditional channels include the branch/agent/broker channel), around half of the tech-savvy and Gen Y customers surveyed say digital channels are also very important. “Adoption of digital by the insurance industry is key to addressing the service gaps and to implement more regular and meaningful customer engagement through value-added services.” More than 45 per cent of Gen Y and tech-savvy customers in Canada said the internet, a company’s website and mobile apps were important insurance transaction channels.

If companies get it right, technology will likely fuel a great deal of change in business development and prospecting.

Proactive, personalized offerings

Compared to their global counterparts (the survey of 10,000 customers covered 20 different countries), Canadian customers were far more willing to receive proactive, personalized offerings from their insurers. Moreover, they say Canadian customers who think of their insurers as being highly proactive, report having a much higher positive experience overall. Interestingly, non-tech-savvy customers were most likely to report a positive experience when an insurer is proactive.

Globally, 65.7 per cent of insurers say the need for end-to-end personalization will be the most pressing business imperative for the insurer of the future. Over 72 per cent say improved customer centricity is the key top-line benefit of being more digitally agile. Over 77 per cent say faster turnaround time was is the key bottom-line benefit.