Households today are more likely to rely on life insurance provided by their group plan rather than opt for permanent insurance like whole life, LIMRA reports. This stance can easily lead to underinsurance. Fewer households than ever hold a life insurance policy.

Even if Canadians say they prefer to buy insurance from the advisor network, many buy insufficient insurance, if any. LIMRA announced these findings in the highlights of its 2013 Canadian Life Insurance Ownership Study.

Almost half of survey participants (41%) have term life insurance only, up 27% since 2006, and 46% have permanent insurance only. The survey also finds that 13% have both forms of insurance.

These households tend to be better insured: the survey estimates the average period for which the coverage can replace the primary wage earner’s income in case of death at seven years. Those with term insurance only can expect to replace it for 5.5 years, compared with 3.5 years for permanent insurance holders.

For households whose main wage earner is insured only by group insurance, financial woes loom. On average they can expect to replace the missing income for only two years.

However, total reliance on group insurance is growing. This year, the segment comprised 37% of households, up from 28% in 2009.

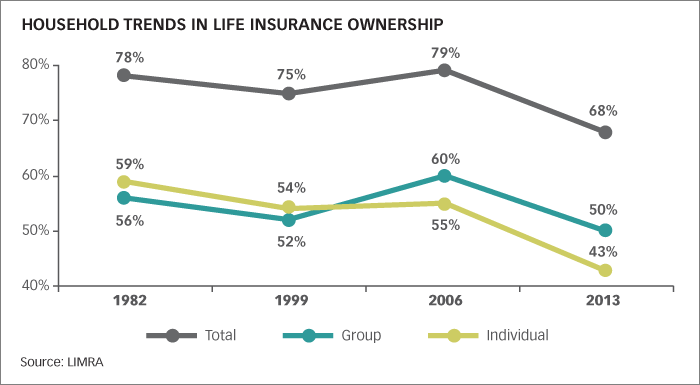

Worse yet, life insurance holding has sunk to its lowest point in 30 years. Only 68% of Canadian households have life insurance, compared with 79% in 2006 (and 78% in 1982). This plunge results from the fact that the number of life insurance policies in force in Canada dove 18%, from 41.6 million in 2009 to 34.2 million in 2012.

The economy has spurred this decline, but it’s not the only factor. Despite their concerns about financial security, families do not consider buying insurance a priority. What’s more, the size of the sales force is not keeping pace with the Canadian population.

“When we asked what keeps consumers from buying life insurance, the top two reasons given were: low priority and a perception that it’s not affordable,” says Cheryl Retzloff, senior research director for LIMRA.

The result: married households with children under age 18 claim to be underinsured; three-quarters of households say they would have difficulty meeting their daily living expenses if they lost their primary wage earner.

Canadians’ concern about their financial future opens the door to conversations with advisors. Well before repaying their debts, Canadians of all ages rank the government’s capacity to finance healthcare as their prime worry (84%). Eight out of ten Canadians fear they won’t have sufficient funds during retirement.

79% of Canadians are concerned about the cost or accessibility of long-term care. In similar proportions, they worry about having sufficient monthly retirement income and sufficient funds in case of disability or critical illness.

In contrast, reducing debt (59%), meeting the family’s needs in case of death (54%) and paying for children’s studies raise less concern.

For Canadians who did purchase insurance, covering final expenses (57%) and the need to have this product (43%) were the main motivations. Only 37% of Canadians bought life insurance mainly to replace income in case of death.

According to the LIMRA report on individual life insurance in Canada in 2012, term insurance sales continue to dominate the market, at 58% of policies sold in 2012. Whole life and universal life split the remainder into equal shares of 21%.

Recruitment stalling

Even as they try to engage more Canadians in conversation, the sales force is up against an industry that is struggling to recruit new blood.

Canadian consumers say they prefer personal contact, yet another LIMRA study found that the industry recruited 14% fewer sales professionals in 2012, at 13,500 versus 15,600 a year earlier.

“This combination of fewer agents and slow adoption of non-face-to-face purchasing creates a real challenge for Canadian insurance companies,” Ms. Retzloff points out.

The 2012 survey is based on a sample of 3,200 Canadian households. The person surveyed was the self-declared financial decision-maker of the household. Results were weighted to represent all households in Canada. The previous edition of this study was conducted in 2006.