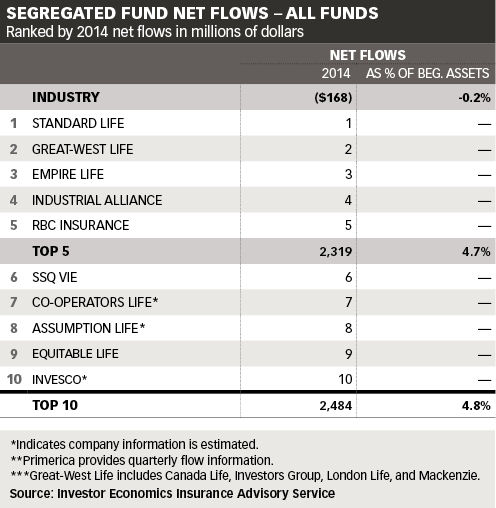

In 2014, total industry net flows (sales) of segregated funds were “mildly negative” at -$168 million. However, when gross sales are analyzed, traditional segregated funds are showing strength, says Karol Kalejta, senior analyst with Investor Economics.The negative net flows result is explained by a mix of factors, including redemptions of older traditional products. “Those products, sold 10 or 15 years ago, are now maturing and people are redeeming them,” Kalejta says. Industry segregated fund net flows went much further into negative territory in 2013 at -$1.174 billion (See The Insurance and Investment Journal, March 2014).

Although Investor Economics does not track where the money goes after being redeemed, it is likely that some older clients may be annuitizing the money rather than putting it back into a segregated fund, Kalejta says.

Also “driving the net flow picture is the pull back or retrenchment of the GWB (guaranteed minimum withdrawal benefits) product shelf,” he adds. GWBs are segregated fund products that offer a guaranteed income stream in retirement. Their previous popularity contributed to high industry sales. Over the last few years, however, some carriers have stopped selling them or restructured their products, which resulted in a sales decline.

Gross sales

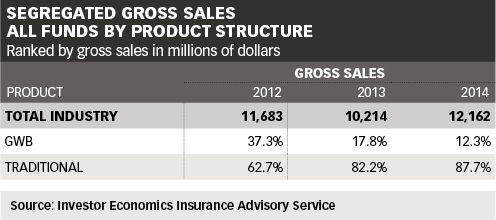

In 2014, gross segregated fund sales stood at about $12.162 billion, according to Investor Economics Insurance Advisory Service’s data. This is up from $10.214 billion one year earlier (see table below).

When analyzing gross sales, Kalejta explains that what’s most interesting is that even though GWB sales are down, traditional segregated funds – those that do not offer a guaranteed income stream – have done “very, very well. They’ve grown year over year.” Investor Economics’ data shows that traditional funds accounted for 87.7% of gross sales in 2014 and GWB products 12.3%. By comparison, in 2012, GWBs accounted for 37.3% of gross seg fund sales while traditional seg funds accounted for 62.7%.

The fact that gross sales for traditional products are increasing “speaks to the resilience of the insurance advisor, sales networks and the distribution channels,” Kalejta says. “They’re very resilient. They continue to sell products even though GWBs might not be the hot selling item they were a couple of years back.”

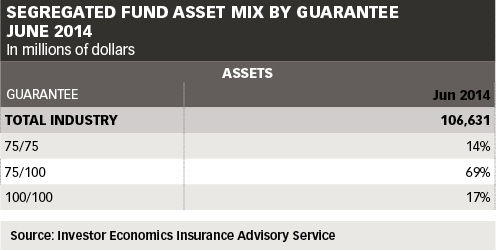

Segregated funds with lower guarantees have sold substantially with double digit growth from 2013 to 2014, he adds. According to Investor Economics’ data as of June 2014, 69% of the industry’s segregated fund assets were in the 75/100 guarantee category. The 75/75 guarantee made up 14% of assets and the 100/100 category stood at 17%.

For segregated funds, “2014 was a much better and stronger year” than a couple of years ago when there were a lot of changes in the market, Kalejta observes. The equity class of these products is especially strong due to the strength of the North American markets. “That mood is reflected in the sales of mutual funds and also traditional segregated funds,” observes Kalejta.

Total assets up

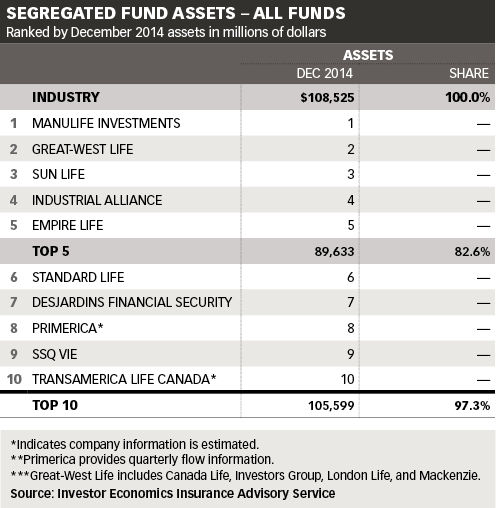

At $108.5 billion, total industry segregated fund assets were up about 8% in 2014 over the year previous. This increase is “largely driven by market effect, the equity markets and the performance of segregated funds, which have done very well,” says Kalejta.

In terms of gross sales and assets, the biggest players continue to occupy the top five spots (see rankings below). On a net flows basis, Standard Life (recently acquired by Manulife Financial) had the highest sales. “That’s because they have a much younger book of business so they don’t have redemptions from older products and they have also been very successful in generating new business,” explains Kalejta.

Another interesting trend in the seg funds market is the flurry of recent product launches. “You are seeing quite a bit of new product development…It’s definitely an interesting time for the business and there are companies coming up with new solutions and even revamping their current offerings…You’ll probably see a lot more launches in the next year as well,” he predicts.

Outlook

Looking at the big picture, he expects segregated funds to remain an important tool on advisor’s shelf, especially with the aging population. A wealth product with insurance features addresses key needs for these clients, particularly in regards to passing on assets to the next generation. Segregated funds are uniquely positioned to be used in situations involving estate planning, wealth transfer, probate taxes, etc. “Segregated funds are probably one of the only solutions that can very effectively do that.”

Insurance advisors are also very uniquely positioned due to their experience and comfort level in discussing issues related to death, beneficiaries, and “the big picture plans of life”, Kalejta says, adding that segregated funds are well suited to this discussion.