As the year 2016 draws to a close, The Insurance & Investment Journal suggests you read or re-read our 10 most popular articles. From the end of sales-based travel incentives for advisors, to new rules coming into effect January 1st 2017, it has been an interesting year!

1 - Changes to exempt test rules coming

With higher tax rates and lower allowable contribution limits to Tax-Free Savings Accounts, Canadians may be looking for new ways to shelter their money. But if they want to do it through permanent exempt life insurance policies, they better move quickly because of new rules coming into effect January 1, 2017.

2 - Bye bye sales-based travel incentives for advisors

On March 14, 2016, Great-West Life and Canada Life announced the end of sales-volume based incentive conferences for advisors. Instead, they plan to transition towards open eligibility events that focus on advisor development for their independent distribution channels.

3 - Manulife paid out $24.6 billion to customers in 2015

On May 16, 2016, Manulife Financial released a public accountability statement to explain how the insurer and its subsidiary John Hancock contributed to the economic, environmental and social well-being of customers, employees, and communities in 2015.

4 - Ontario updates Insurance Act

In a bulletin published on Jan. 6, 2016, the Financial Services Commission of Ontario (FSCO) noted that various amendments related to both life insurance and accident and sickness insurance were scheduled to come into effect on July 1, 2016, as are a number of new regulations.

5 - Marijuana users considered as non-smokers

Five life insurers announced that they will underwrite marijuana users as non-smokers. Sun Life says it will treat all of those who consume marijuana but do not smoke tobacco as non-smokers. BMO Life Insurance is taking a more conservative approach.

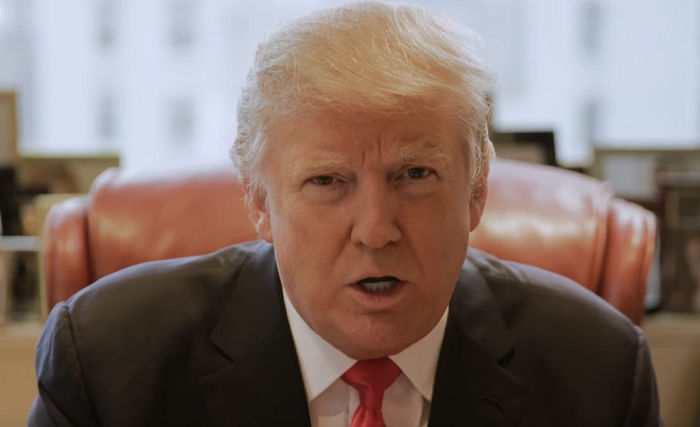

6 - ivari and Donald Trump’s hair

ivari, the Canadian life insurance company, found itself dealing with a hairy situation when confused Twitter users mistook it as the producer of the U.S –president-elect’s “fake” hairdo. The problem arose when social media users confused ivari for French hair restoration company Ivari International.

7 - A massive scheme of dishonesty

After they made off with more than $6 million of their clients' money and left the Investor Protection Corporation holding the bag, the Mutual Fund Dealers Association (MFDA) permanently prohibited Dianne Stuart and her husband Howard Stuart from working in the mutual fund industry.

8 - CLHIA says sales practices could be improved

The Canadian Life and Health Insurance Association (CLHIA) conducted a review of how individual insurance is sold. It recommended a number of changes which, if implemented, could change the way some advisors do business and the travel rewards they receive.

9 - Advisor's response to MFDA: "I don't care"

A decision from the Mutual Fund Dealers Association (MFDA) considered the lengths to which regulatory staff are required to go when providing disclosure and documentation to the advisors it is investigating.

10 - Disclosure requirements for segregated funds to change

In a Segregated Funds Working Group Issues Paper, The Canadian Council of Insurance Regulators (CCIR) said disclosure requirements will change for segregated funds.