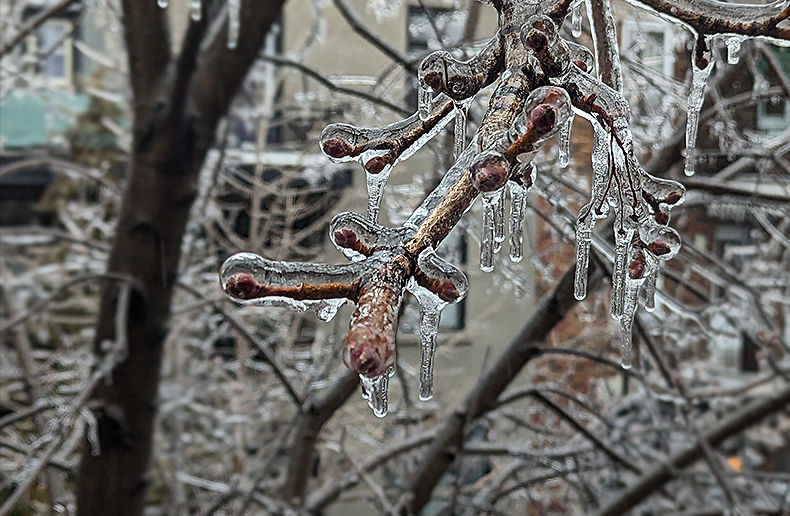

The storm that slammed Eastern Canada from March 26 to 29 caused $50 million in insured damage due to high winds and heavy rain.

These estimates, issued by Catastrophe Indices and Quantification Inc. (CatIQ), were published in a news release by Insurance Bureau of Canada (IBC).

In fact, five provinces felt the brunt of the storm, ranging from flooded basements in southern Ontario to roofs torn off homes in western Newfoundland and Labrador:

“Insured losses related to natural catastrophic events averaged $2 billion per year between 2009 and 2020, compared with an average of $422 million per year in the 1983 to 2008 period. That's more than a four-fold increase in such losses caused by severe weather events, which are increasingly attributed to climate change,” IBC Vice-President, Federal Affairs Craig Stewart explains.

In 2020, these losses totalled $2.4 billion. This was a record year.

Call for a national strategy

The release of the estimates was coupled with a call for a national climate adaptation strategy with measurable targets. “Taxpayers and insurers share the cost for severe weather damage. For every dollar paid in insurance claims for homes and businesses damaged by severe weather, all levels of government and taxpayers pay much more to repair public infrastructure. Yet Canada still lacks a national strategy and the accompanying investments needed to protect Canadian homes and businesses from natural disasters,” the Canadian insurance association points out.

Canadians continue to face increasing financial losses due to climate change, IBC adds. The association mentions that although the federal government created the Task Force on High-Risk Residential Flood Insurance and Strategic Relocation in 2020, this is a stand-alone effort.

IBC concludes by expressing its interest in being part of a broader climate adaptation plan that coordinates government and private sector actions to address the growing physical risks of climate change.