Quebec is considering changes to its provincial pension plan. Depending on which proposals are implemented, they could make pension administration difficult for national employers.

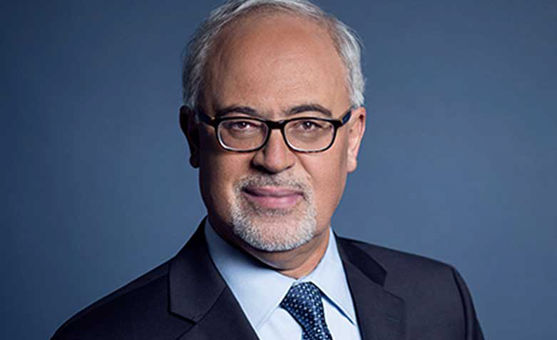

Earlier this month Quebec Minister of Finance Carlos Leitão opened a public consultation on the future of the Quebec Pension Plan (QPP).

The province is considering improving the benefits available under the QPP, as well as what kind of contribution rates are required to ensure the sustainability and intergenerational fairness of the plan. In particular, the government is proposing three options: matching the recent enhancements to the Canada Pension Plan (CPP), increasing QPP benefits the income replacement rate for those who earn more than $27 450 from 25% to 33.33%, or remaining with the status quo.

In its December newsletter (PDF), benefits consulting firm Morneau Shepell suggests legislators are most inclined to go with the second of the three enhancement options. Among other things, the article notes that people in Quebec' already have to pay higher contributions for their retirement benefits than workers in the rest of Canada, so the government needs to find a way to contain further increases and avoid a public backlash.

If Quebec does proceed with proposal number 2, it will make pension administration a little more difficult for national employers with earnings-related pension plans, but not insurmountable," says Morneau Shepell. "One element that is not clear is how the Quebec government could implement changes to GIS [Guaranteed Income Supplement] since it is a federal program. This consultation should generate a lot of discussions in early 2017."