A report from KPMG suggests that insurers will need to take "drastic measures" in order to reinvent themselves.

In Empowered for the Future: Insurance Reinvented, which was released earlier this week, KPMG argues that insurers need to make fundamental changes to their business and operating models. "Success in the insurance industry of the future will not come from simply tweaking the status quo, insurers will need to change virtually every part of their business if they hope to not just survive, but thrive," reads the report.

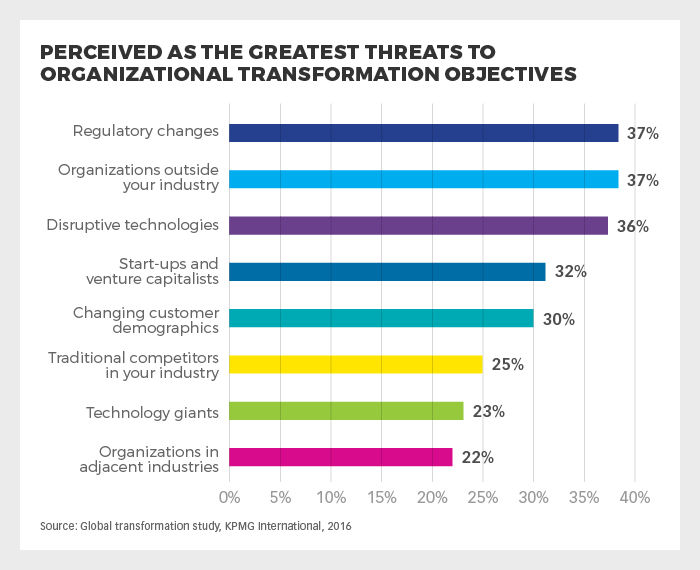

The greatest threats

KPMG surveyed more than 70 insurance executives and asked them about the difficulties they see ahead and how they plan to meet them. Asked about the greatest threats they face (respondents could give more than one answer), executives said they were most concerned by the prospect of regulatory changes (37%), the effect of organisations outside the insurance industry (37%), and disruptive technologies (36%).

The study also found that many executives were frustrated in their efforts to shift towards digital platforms. More than a third of those surveyed (37%) indicated that their legacy technology infrastructure and systems were slowing their change initiatives.

No physical infrastructure

“Technology has evolved to a point where new insurance organizations can be virtually ‘stood up’ in a matter of weeks using almost no physical infrastructure and renting everything from servers through to customer interfaces,” comments William Pritchett, a partner with KPMG in Britain. “This technology is not reserved for start-ups and disruptors. Traditional insurers can also leverage these tools and approaches to create a new value proposition in the market with little capital investment and fairly low risk.”

Potential growth areas

While almost half of the respondents said that mobile platforms and apps (47%), and social networking (45%) were both forcing change in their businesses and creating new opportunities for transformation, KPMG warns that some insurers may be unaware of other potential growth areas. In particular, the study found that only a third of respondents believe that artificial intelligence (AI) and cognitive computing will be either a driver or an enabler, a quarter dismissed the Internet of Things as being inconsequential, and two-thirds said that robotics would not apply to them.

“In some cases, technology can catalyze transformation as the introduction of telematics did to usage-based insurance, but more often technology plays the role of enabler, providing more effective and efficient tools and methods for achieving the business's transformation objectives,” says Mary Trussell, a partner with KPMG in Canada. “You can’t let technology drive the bus, but you also don’t want it to overtake you.