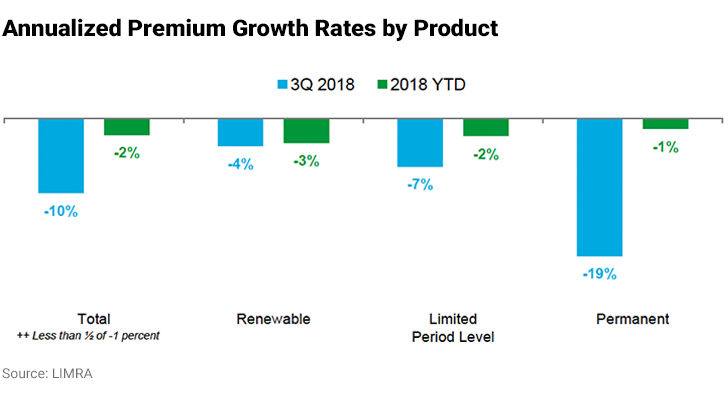

In terms of new annualized premiums, critical illness insurance sales were down 10% in Canada in Q3 2018 compared with the same quarter of 2017, LIMRA reveals in its quarterly report.

Early in 2018, sales of critical illness insurance (CI) got off to a healthy start with Q1 sales 8% higher than for the same quarter of 2017. However, results of the first three quarters of 2018 show a 2% decrease in sales of CI insurance compared with the first three quarters of 2017.

During this comparison period, the number of critical illness insurance policies sold in Canada fell by 5%.

Largest setback in the third quarter

The driving force behind the growth in Q1 – the permanent CI product – sustained the sharpest drop in sales in Q3 2018, down 19% compared with the third quarter of 2017.

During this comparison period, limited period level products saw sales slide by 7% versus 4% for renewable term.

Matthew Rubino, the author of the LIMRA report, Canadian Individual Critical Illness Sales Survey, 2018, mentions that seven of the 16 suppliers surveyed achieved sales growth in critical illness insurance from January 1 to September 30, 2018 compared with the same period in 2017.

Agents suffering

The first three quarters of 2018 were gruelling for insurers’ career distribution network compared with the results of the same period in 2017. “Affiliated agents were a large source of declines, with an 11 percent decrease against 2017 year-to date,” Rubino points out.

In contrast, the independent network boosted its critical illness insurance sales by 4% during the comparison period.

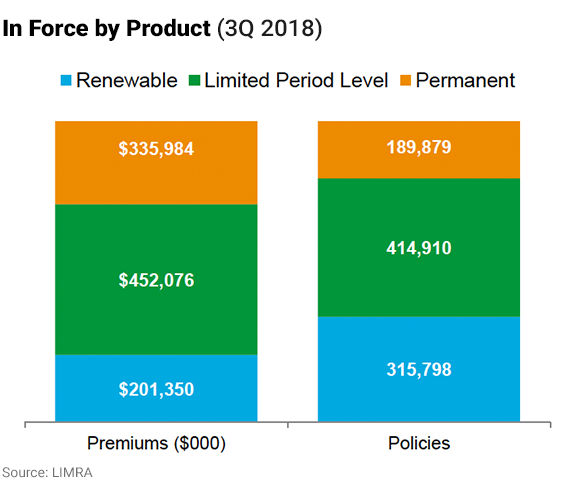

The independent network dominates market share in critical illness insurance sales in Canada. During the first three quarters of 2018, it generated 63.7% of sales. The affiliated agent network made up the rest, at 36.4%.

In both networks, limited period level products accounted for about half of total sales.