A survey conducted by Willis Towers Watson (WTW) has found that nearly two out of three Canadians would be prepared to receive less pay in exchange for better retirement benefits.

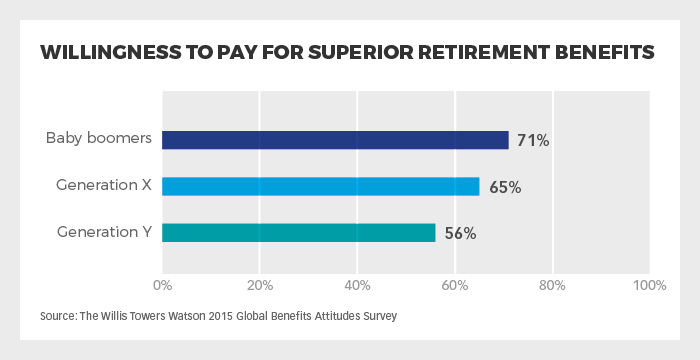

In a poll of more than 2,000 Canadian employees, WTW found that 62% of the participants would be willing to bring home a smaller paycheque in return for a more generous pension plan. A slightly higher number of respondents (65%) indicated that they would pay more if they could receive a pension that was guaranteed for life. The older the employee, the more inclined they were to pay for superior retirement benefits: 71% of Boomers were ready to pay more, followed by 65% of Generation X and 56% of Generation Y.

The survey also revealed that many Canadians are unprepared to face retirement: 32% anticipate retiring later than previously planned, 26% think they will have to keep working past past age 65, and 13% believe they’ll have to work past age 70 in order to have enough money to to live comfortably.

“Canadian workers remain concerned about their retirement financial stability,” says Karen Burnett, senior retirement consultant at Willis Towers Watson. “Some will be fortunate and inherit wealth from their ageing parents. Others may need to overcome inadequate savings by selling assets such as their homes before they would otherwise prefer. For many, however, the default option will be to work longer.”